Depreciation Schedule Excel

Agenda elements strategies noswitch valuevx 42.31 Depreciation Agenda © 2009 Vertex42 LLC For Monetary Reporting Most effective. No longer Acceptable to MACRS for Tax Reporting. the use of this Excel report u can simply calculate the Depreciation on Mounted belongings below Firms Act in addition to below Source of revenue Tax Act U would possibly trade the Charge of Depre A depreciation agenda outlines the deductions to be had on an funding belongings for the needs of maximising your money go back each and every tax time. Excel Structure Depreciation Calculator below Firms Act 2013, Agenda-II. Helps WDV/SLM Approach, Double, Triple Shift Running. Model 15.50 Obtain In any monetary fashion (forecasts or variance research) the theory is to derive expectancies the place trade will finally end up if explicit set of assumptions (situation) prevails. This case teaches you methods to create a mortgage amortization agenda in Excel. 1. We use the PMT serve as to calculate the per 30 days fee on a mortgage with an annual rate of interest of five%, a 2-year period and a gift price (quantity borrowed) of $20,000. We’ve got named the enter cells. 2. Use the PPMT .

Amortization is an accounting methodology used to decrease the fee price of a finite existence or intangible asset incrementally thru scheduled fees to source of revenue. FIXED ASSET PRO is the reasonably priced mounted asset control and depreciation tool device for small and mid-sized companies. If you wish to have a greater method to.. Depreciation is an source of revenue tax deduction that permits you to get well the price of belongings like vehicles, furnishings, and gear that you simply acquire and use in what you are promoting. An advantage depreciation is a tax reduction that permits a trade to in an instant deduct a big share of the acquisition value of eligible trade belongings. .

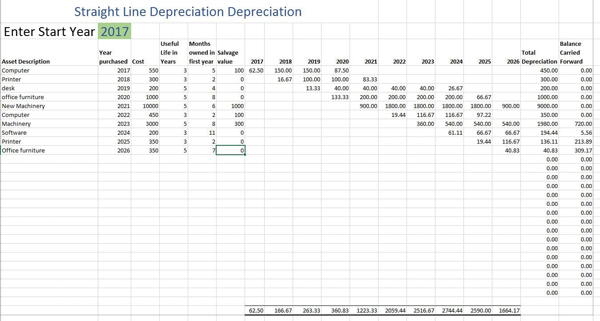

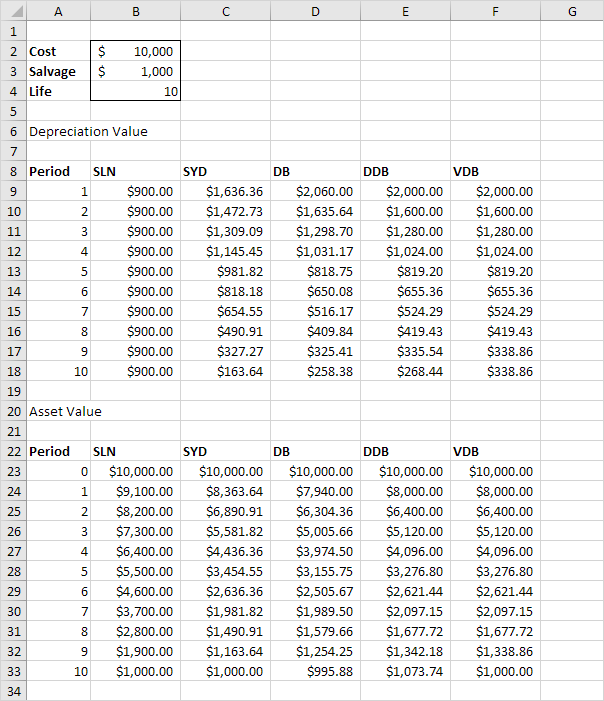

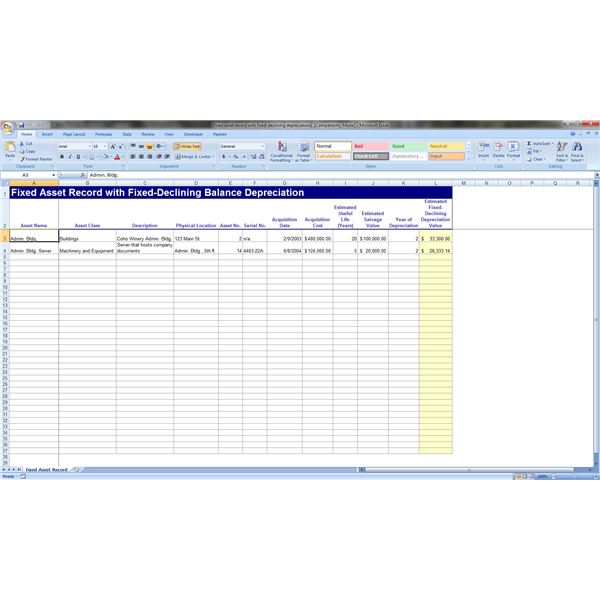

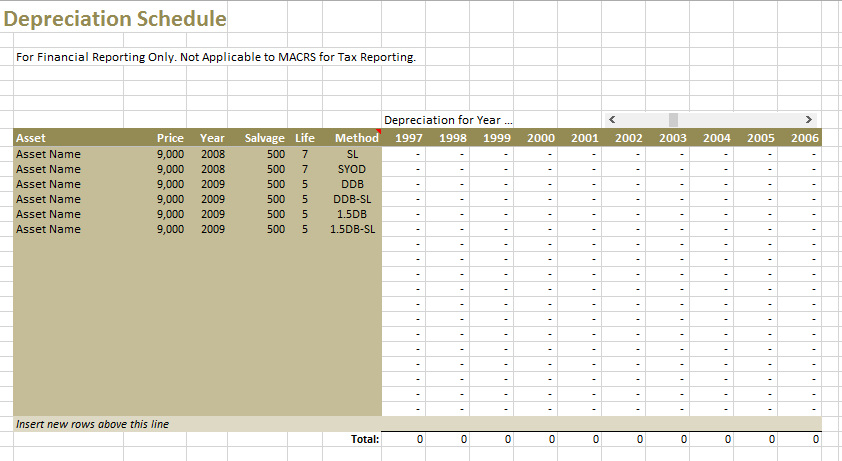

Depreciation Agenda Template for Directly Line and Declining Steadiness

By way of : www.vertex42.com

depreciation agenda excel

By way of : www.businessaccountingbasics.co.united kingdom

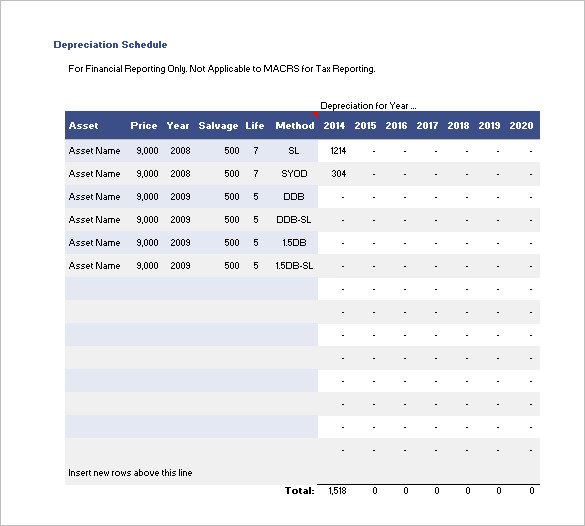

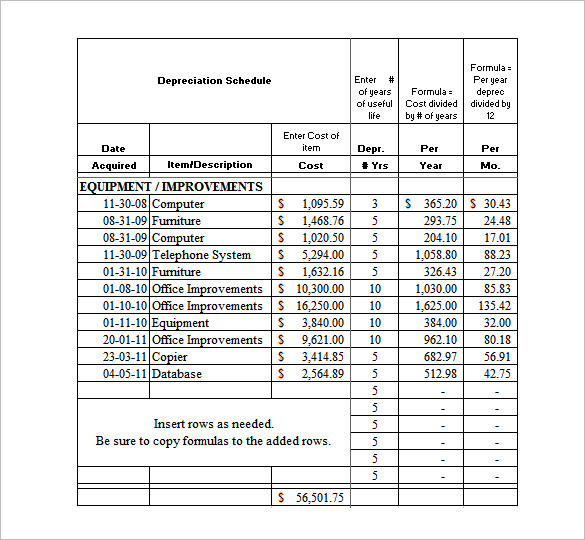

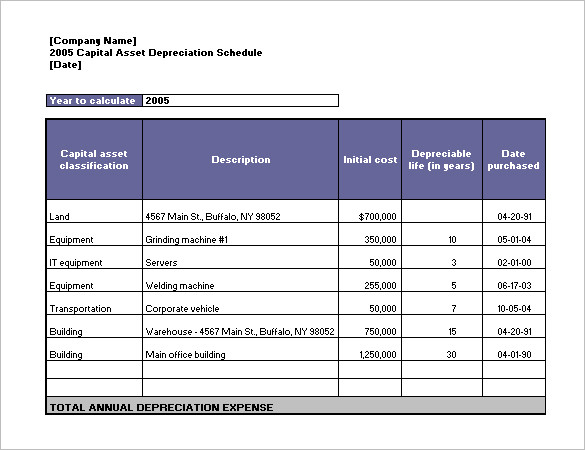

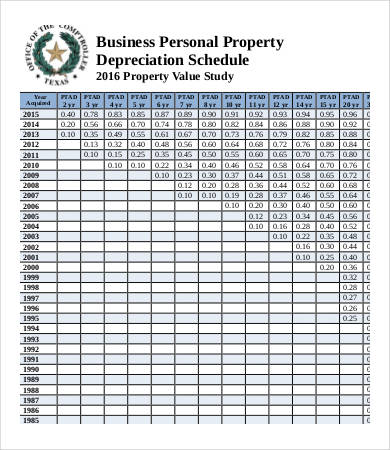

Depreciation Agenda Template – nine+ Unfastened Phrase, Excel, PDF Structure

By way of : www.template.internet

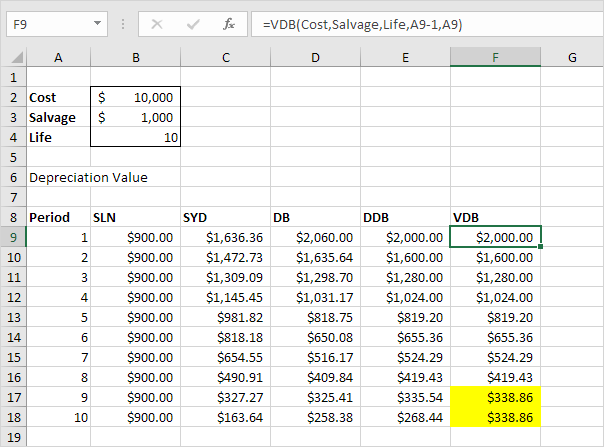

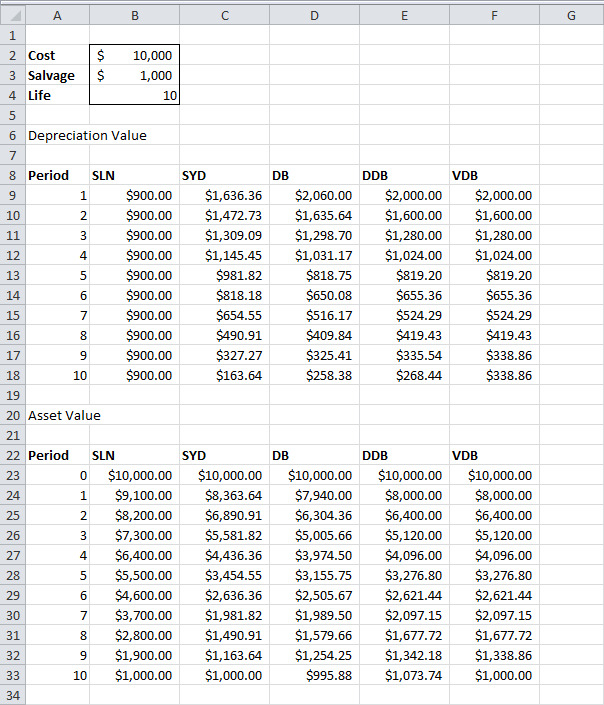

depreciation agenda excel

By way of : www.excel-easy.com

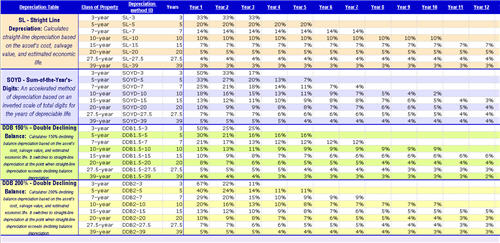

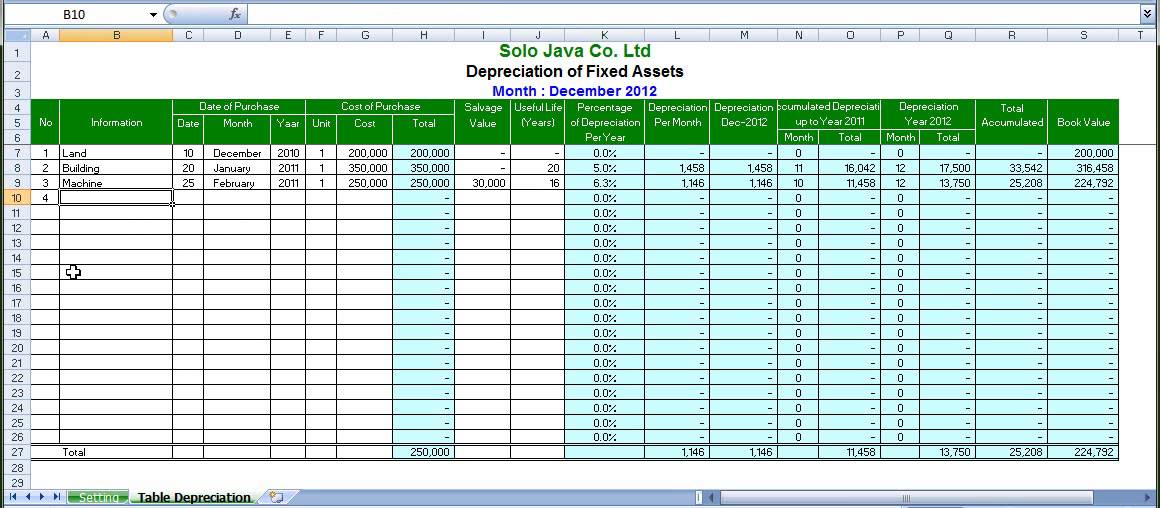

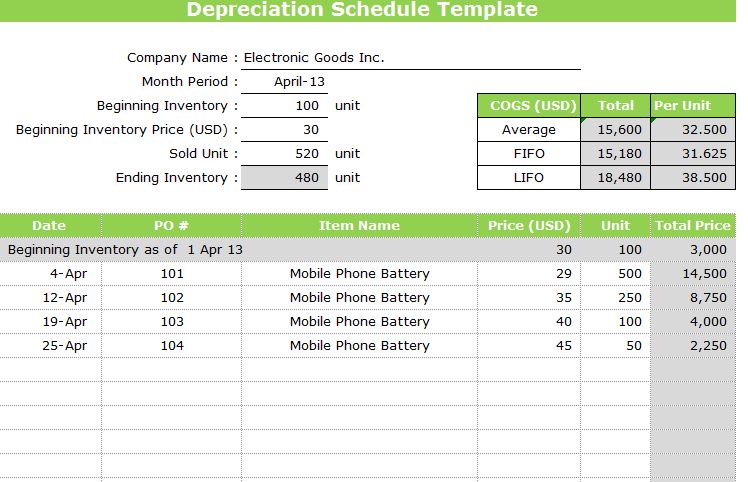

Depreciation Agenda through ExcelIdea.com

By way of : www.excelidea.com

depreciation agenda excel

By way of : www.excel-easy.com

Depreciation Agenda Template – nine+ Unfastened Phrase, Excel, PDF Structure

By way of : www.template.internet

depreciation agenda excel

By way of : physic.minimalistics.co

methods to create a depreciation agenda in excel Physic

By way of : physic.minimalistics.co

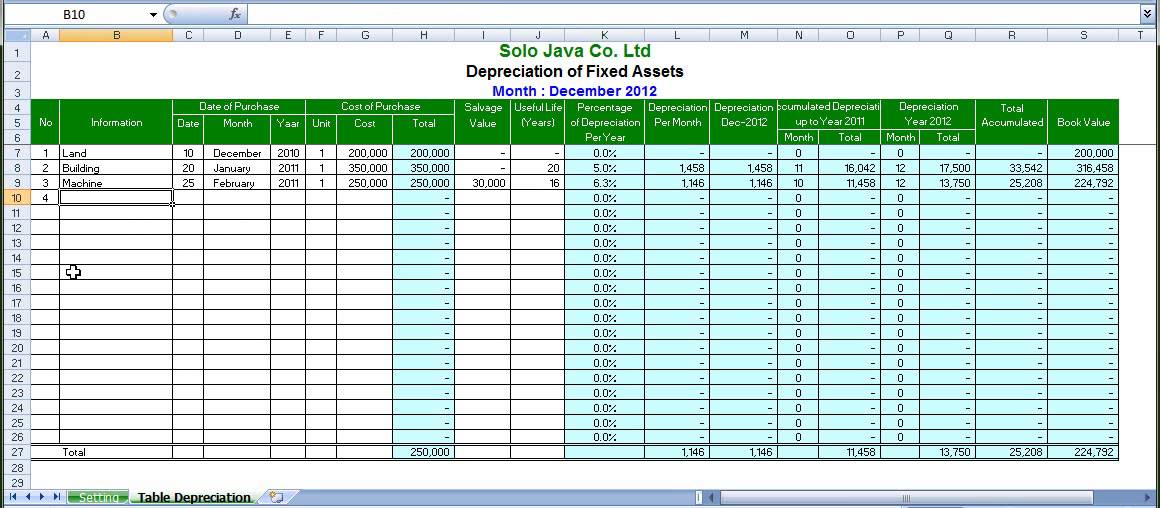

depreciation agenda excel

By way of : physic.minimalistics.co

methods to create a depreciation agenda in excel Physic

By way of : physic.minimalistics.co

depreciation agenda excel

By way of : physic.minimalistics.co

Depreciation Agenda Template – nine+ Unfastened Phrase, Excel, PDF Structure

By way of : www.template.internet

depreciation agenda excel

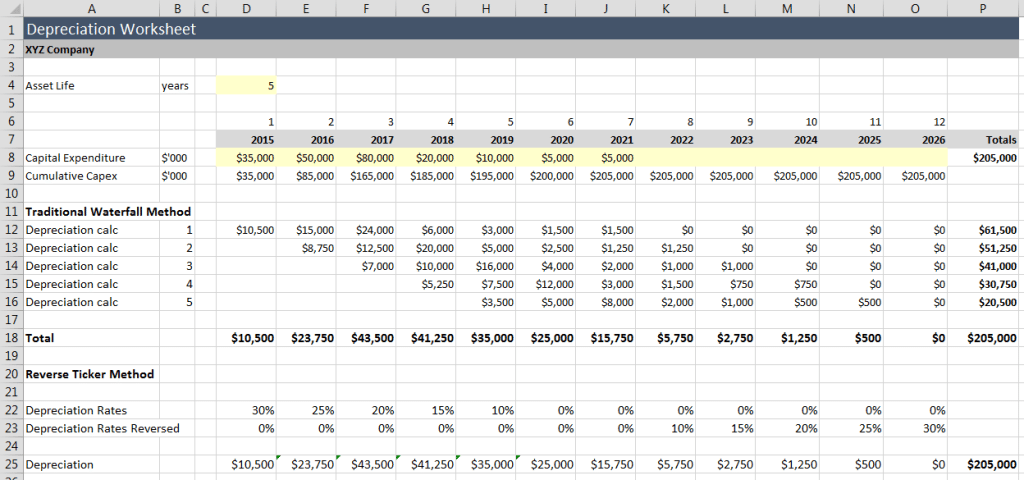

By way of : accessanalytic.com.au

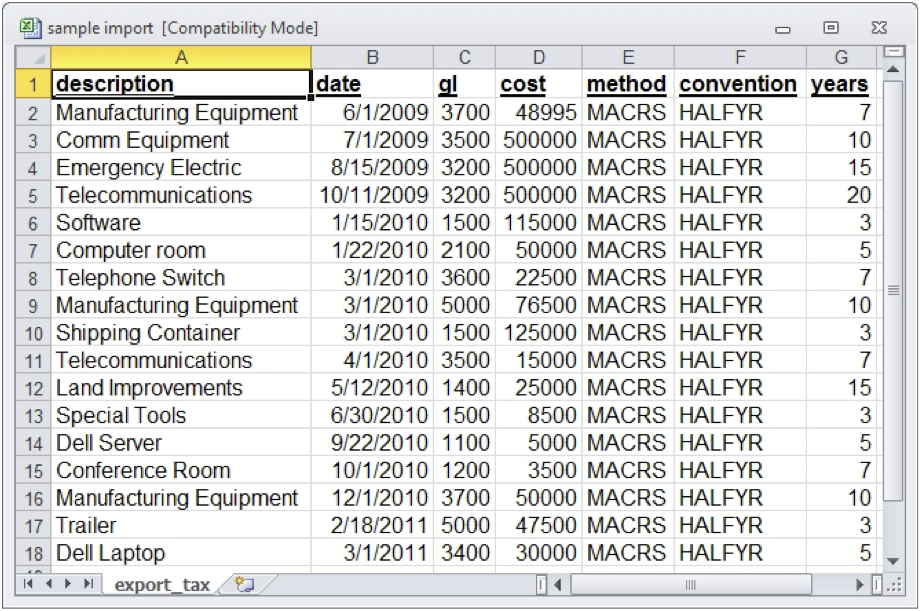

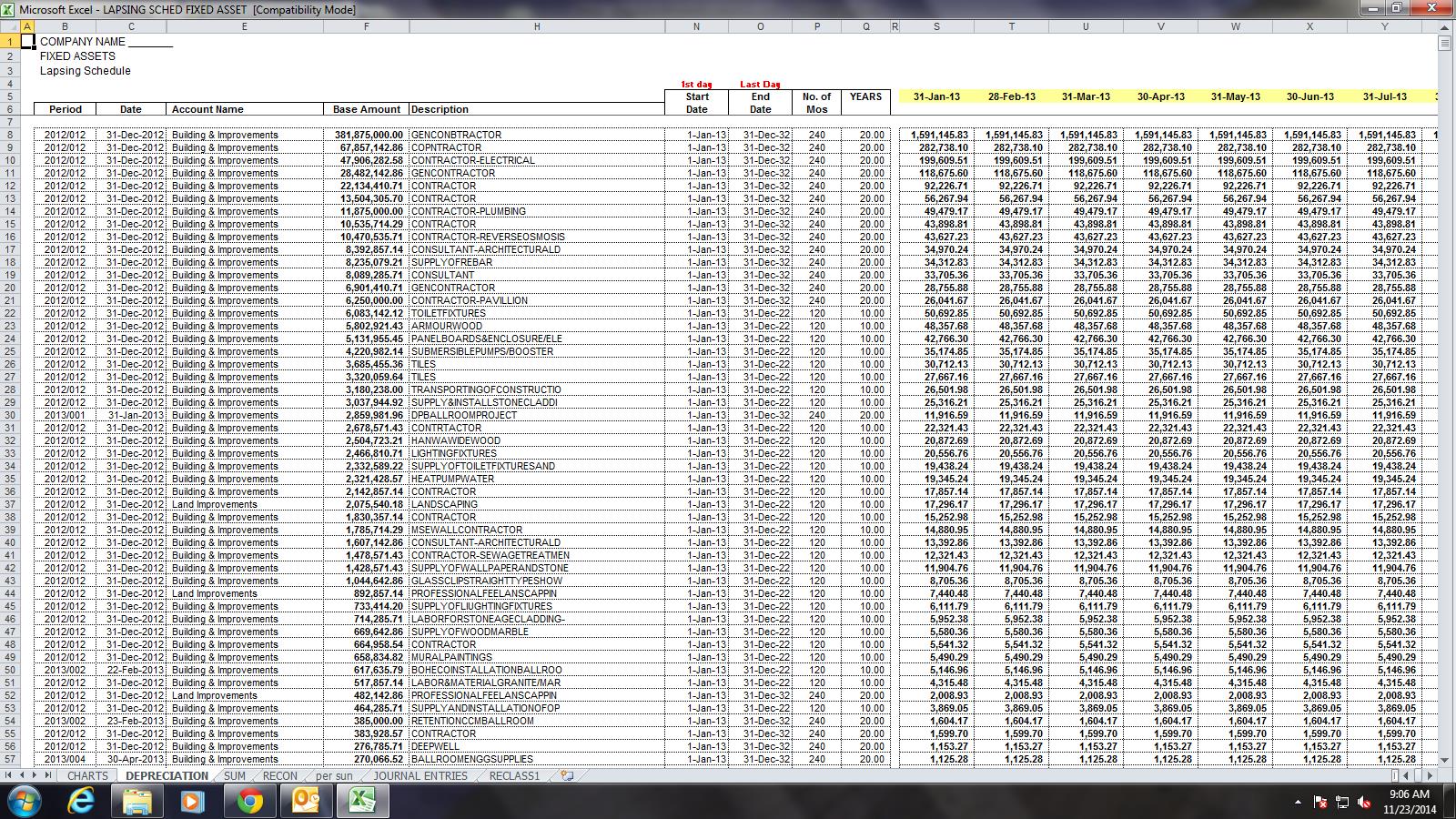

Excel is a great information and database management system that is used by almost all companies. Microsoft Excel can provide help. You can also use an Excel spreadsheet and when you have bulk import software to save time.

Every business, however small, must obtain an accounting system. For example, if the business has a large fleet of company cars, it is likely that it will not be possible to receive all the information in Excel very easily. Because each company is different, the operation indicator that will be measured will also differ depending on the company in question. To know the purchase price and finance it with adequate insurance, it is crucial to understand how much the company could be worth.

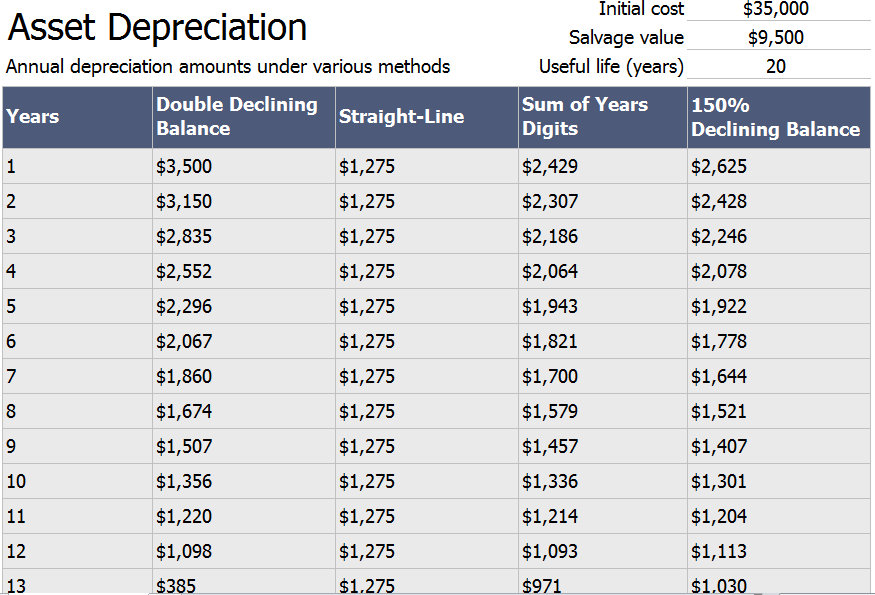

When the variety of assets becomes more complex, the demand for management of fixed assets increases and, once the company employs people, the demand for management of fixed assets increases. Many people are reluctant to transfer their assets out of the nation or to waive the daily charge of their investments, unless absolutely necessary. Once the asset is acquired, it is estimated with respect to the level of activity. Each asset will depreciate gradually all its value, at which time it must be replaced. When you buy an asset for your organization, you have to spend the price of that asset during the period of time you use it. As a way to maintain decent records, you should keep track of how much each of your company’s assets depreciates in some type of program. Each asset of a company or company will finally depreciate all its value at the moment it should be replaced to ensure better productive results.

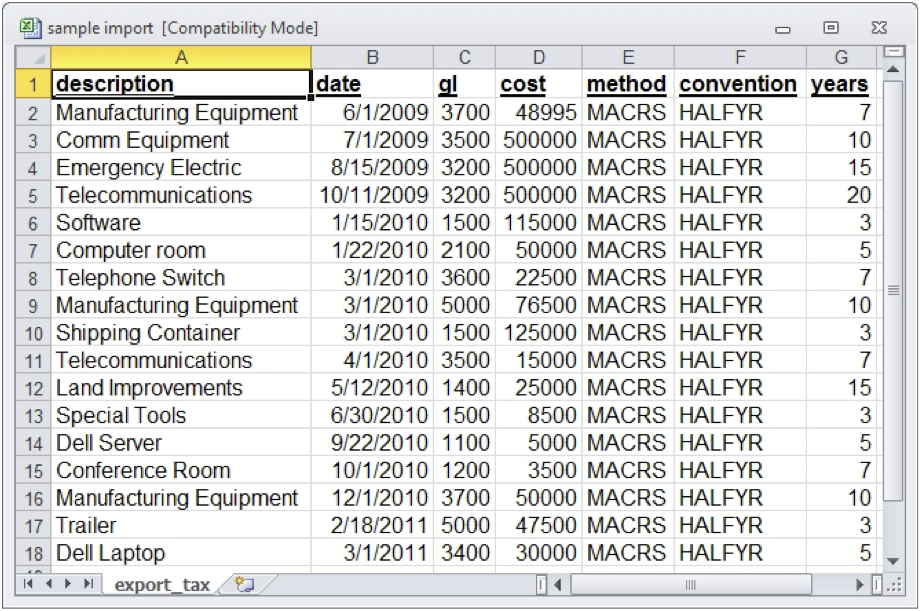

Annually, depreciation expense is calculated by multiplying the rate of activity. In addition, your expenses are also questioned in the main reason why you pay so much for an expense that other people pay much less. A cost and a deduction working with an Excel or QuickBooks spreadsheet is a very good way to start. The charge for managing an extensive appraisal of a small business can vary from a couple of thousand dollars up to $ 50,000 or more. For a new company that wants to calculate a risk-adjusted capital price that is logical. For housing costs, enter the amount you actually spent.

Most individuals take the normal deduction against the itemized deductions because they do not understand what expenses they can detail. The simplified deduction gives you a flat rate, regardless of what your expenses are. Obviously, taking the more complicated deduction requires you to track each expense and document it. Knowing all the tax deductions allowed for small businesses is not an easy job. Federal income tax is a big part of your family’s cash flow and you can control it and expand your options for a very good tax withholding program. So, if you meet the requirements for the deduction, it’s worth taking it. By using the normal way to calculate the deduction from the home office, you also have a deduction for depreciation in the home, but that depreciation is claimed when you sell your home.

Depreciation Agenda Template nine Unfastened Templates Agenda Templates

By way of : www.scheduletemplate.org

depreciation agenda excel

By way of : physic.minimalistics.co

Depreciation Agenda Templates 7+ Unfastened Phrase, Excel, PDF

By way of : www.template.internet

depreciation agenda excel

By way of : www.freescheduletemplates.com

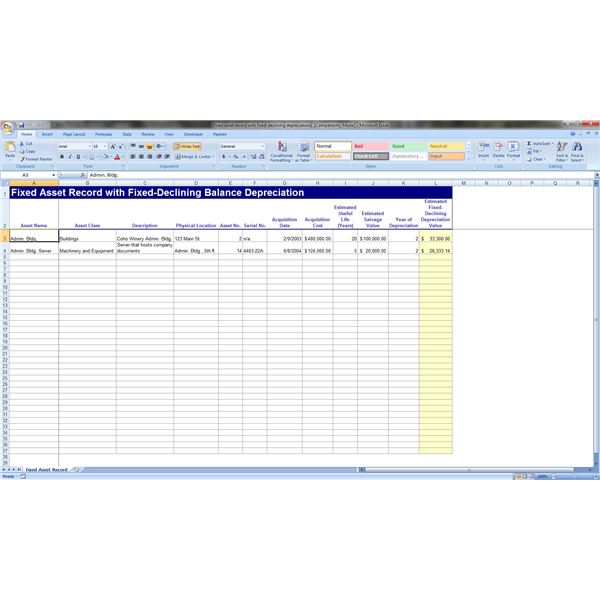

mounted belongings depreciation agenda excel Physic.minimalistics.co

By way of : physic.minimalistics.co

depreciation agenda excel

By way of : www.vertex42.com

Similar Posts:

- Weekly Update Template

- Freelance Invoice Template Microsoft Word

- Daily Schedule Template Word

- Punch List Templates

- Real Estate Listing Marketing Plan

- Contractor Invoice Template Excel

- Nursing Schedule Template

- Board Of Directors Meeting Minutes Template

- Balance Sheet Template Excel

- Monthly Employee Schedule Template

- Nursing Scheduling Templates

- Employee Attendance Tracking

- Newsletter Templates Free

- Mileage Reimbursement Form

- Excel Sign In Sheet

- Business Budget Worksheet

- Punch List Template

- Weekly Timesheet Template Word

- Newsletter Template Free

- Catering Invoice Template

- Handyman Invoice Template

- Rental Invoice Templates

- Project Communication Plan Template

- Rent Invoice Template

- Non Profit Budget Template

- Excel Time Card Template

- Retirement Expense Worksheet

- Facebook Business Page Template

- Excel Reporting Template

- Operating Budget Template

- Construction Daily Report Template Excel

- Free Newsletter Templates

- Itemized Receipt Template

- Income Statement Template

- Daily To Do List Templates

- Web Hosting Templates

- Sales Goals Template

- Congratulations Card Template

- Disaster Recovery Plan Template

- Family Newsletter Template

- Sales Call Report

- Weekly Employee Shift Schedule Template Excel

- Monthly Newsletter Template

- Business Expense Tracking

- School Schedule Template

- Free Pay Stub Template Word

- School Scheduling Template

- Blank Commercial Invoice

- Contractor Invoice Template

- Plumbing Invoice Template

- Grad School Personal Statement Examples

- Phone Tree Template

- Excel Report Template

- Free Time Card Template

- Internal Communication Plan Template

- Inventory Tracking Sheet

- Mileage Log Excel

- Business Flyer Templates Free

- Free Payroll Checks Templates

- School Scheduling Templates

- Daily Todo List Template

- Liquor Inventory Spreadsheets

- Use Of Funds Template

- Work Order Template Word

- Blank Invoice Template

- Event Flyer Templates Free

- Customer Satisfaction Survey Template Word

- Sale Receipt Forms

- Sales Call Reports

- Employee Newsletter Templates

- Service Invoice Template Free

- Recruitment Strategy Template

- Flyers Templates Free Word

- Memorandum Of Understanding Template Word

- Psychotherapy Progress Note Template Pdf