Promissory Note With Collateral

If you want a mortgage, or are taking into consideration giving one, a Secured Promissory Word can give safety for that mortgage. The notice supplies a large number of collateral because the borrower is promising to surrender private assets or actual property if the mortgage is not repaid. Tips on how to Safe a Promissory Word. A promissory notice is a report borrower indicators to vow to pay off a mortgage. The promissory notice on its own creates a prison legal responsibility. A promissory notice is a written promise to pay a collection amount of cash through a specified time to the bearer named within the notice. Usually, it does now not should be formally recorded. Safety Settlement. The clean promissory notice equipped here’s one in every of two choices you’ll be able to use when compiling your Safety Settlement. Items presented as collateral can both be stored through the Lender or stay with the Borrower. Tips on how to Write a Promissory Word. A promissory notice is a written settlement to pay off a debt. Every so often known as a notice, this report is legally enforceable. Pattern Promissory Word. PROMISSORY NOTE. Any proceeds from the sale of the Collateral shall accrue to the Lenders till the notice is paid off in complete. .

Many lenders don’t supply financing with out safety. A promissory notice is a freelance between the financial institution and the borrower. A secured promissory notice is accompanied through different documentation that pledges collateral. A promissory notice, or “promise to pay”, is a notice that main points cash borrowed from a lender and the compensation construction.The report holds the borrower answerable for paying again the cash (plus hobby, if any). Create a loose promissory notice with step by step directions in mins. A promissory notice units the prerequisites and phrases for the compensation of a mortgage. A promissory notice, A notice isn’t invalid through reason why handiest that it accommodates additionally a pledge of collateral safety with authority to promote or dispose thereof. (four) .

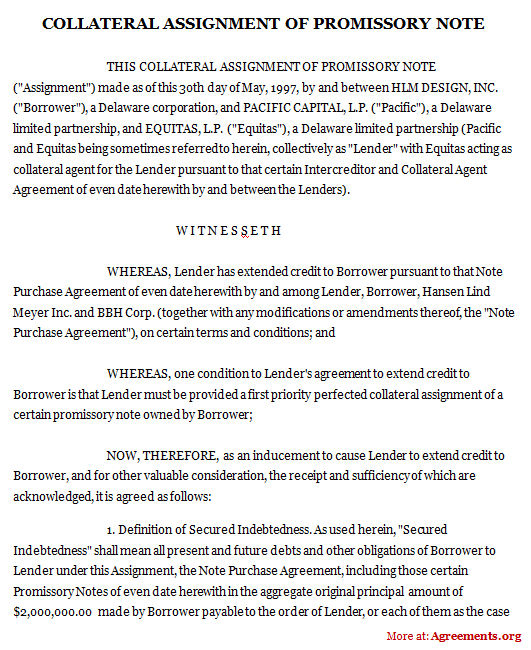

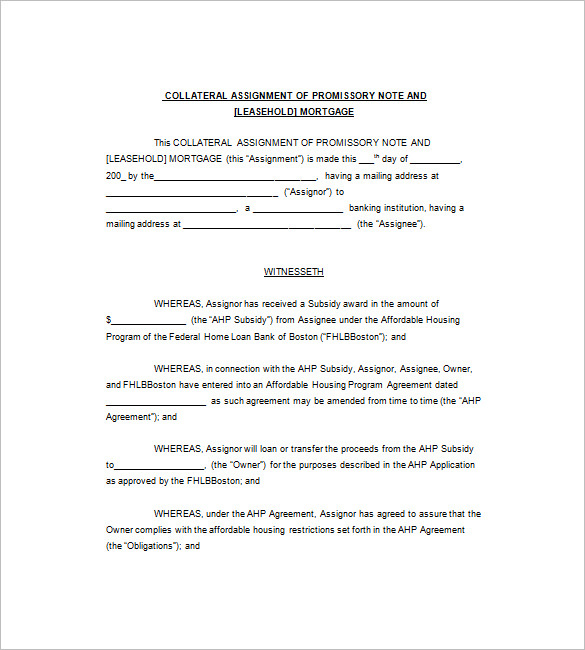

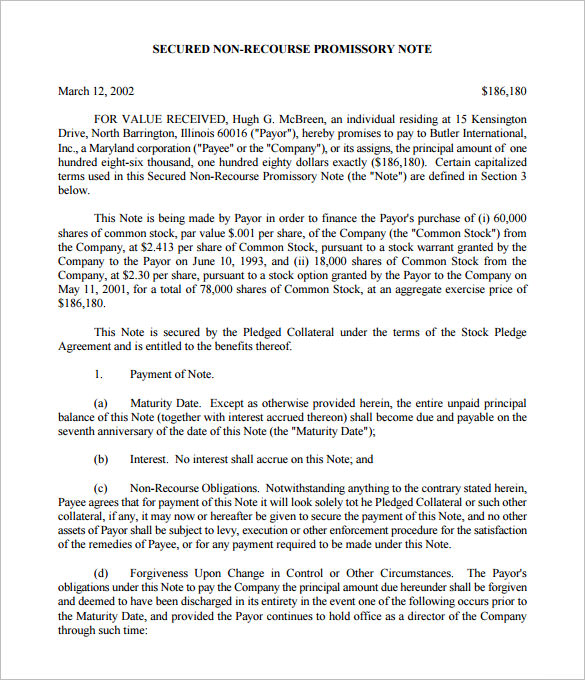

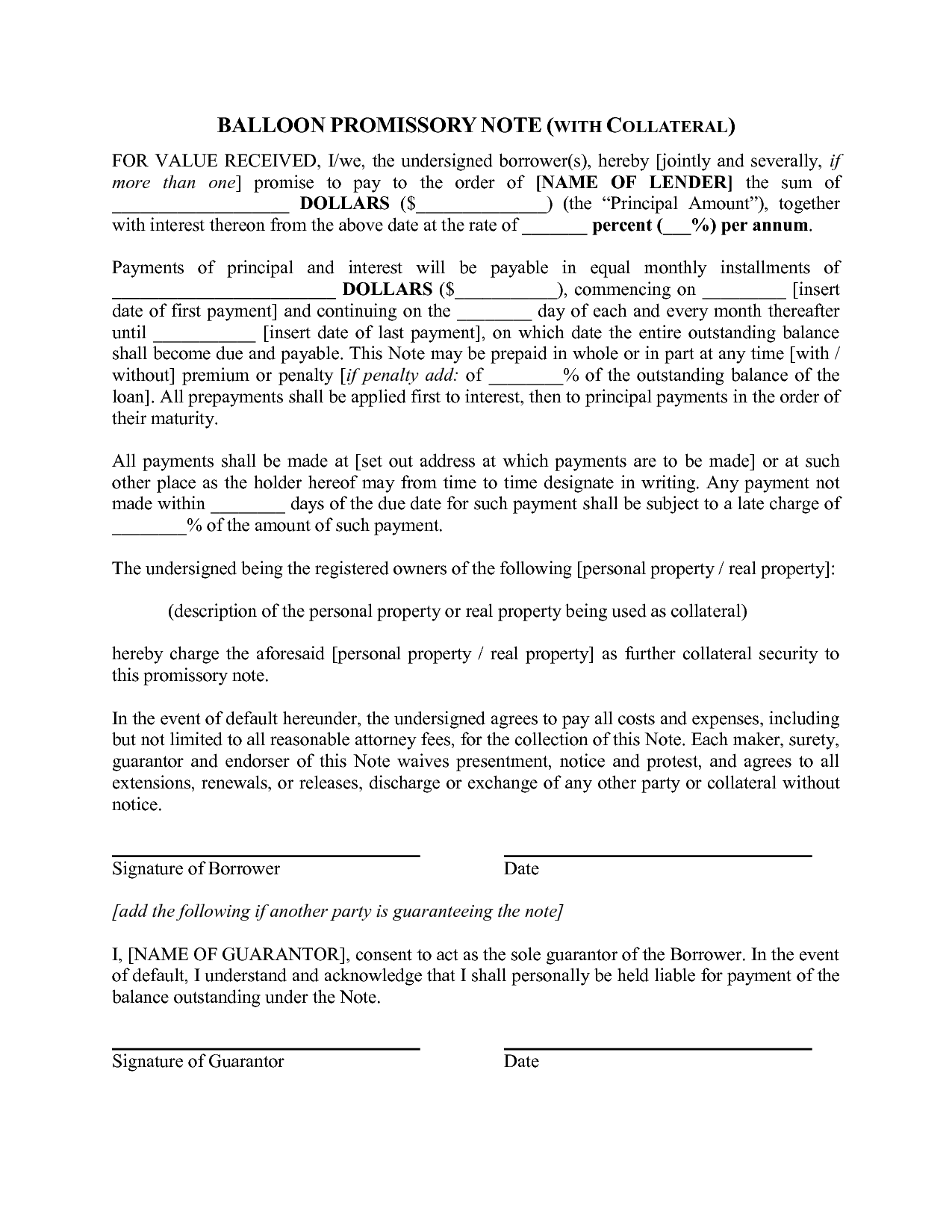

Pattern task of promissory notice collateral useful seize

Via : tattica.information

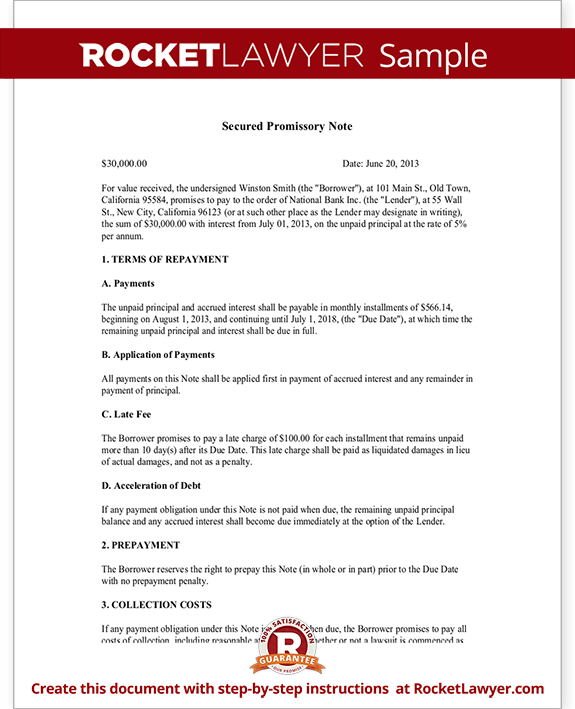

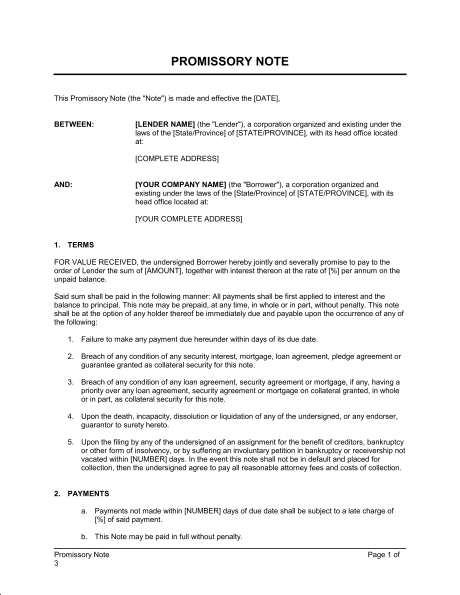

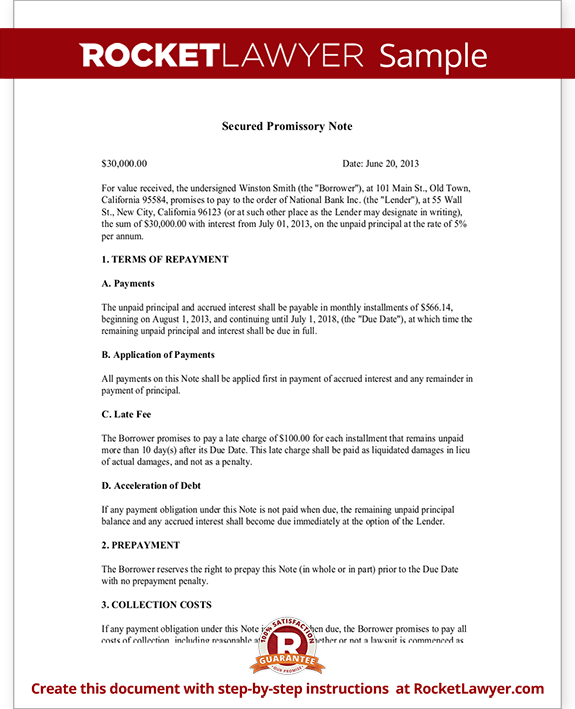

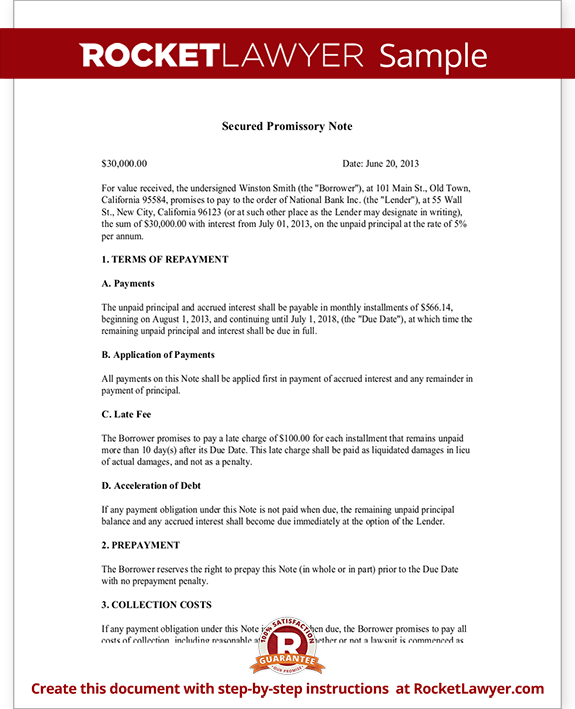

promissory notice with collateral

Via : www.rocketlawyer.com

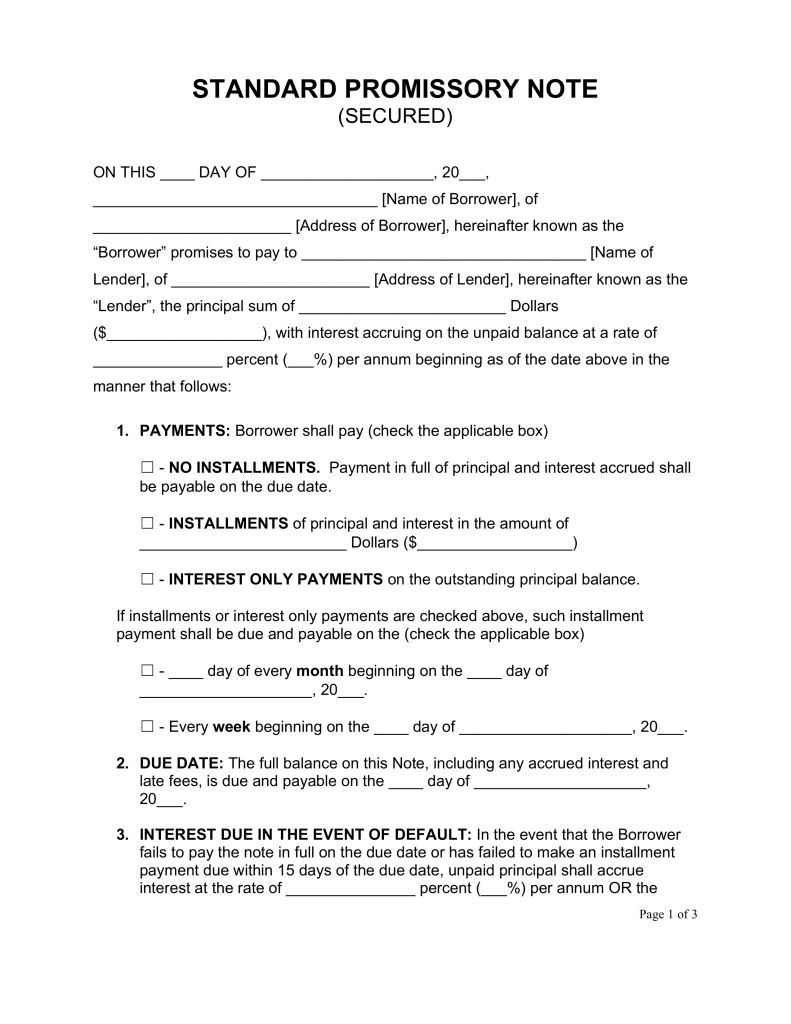

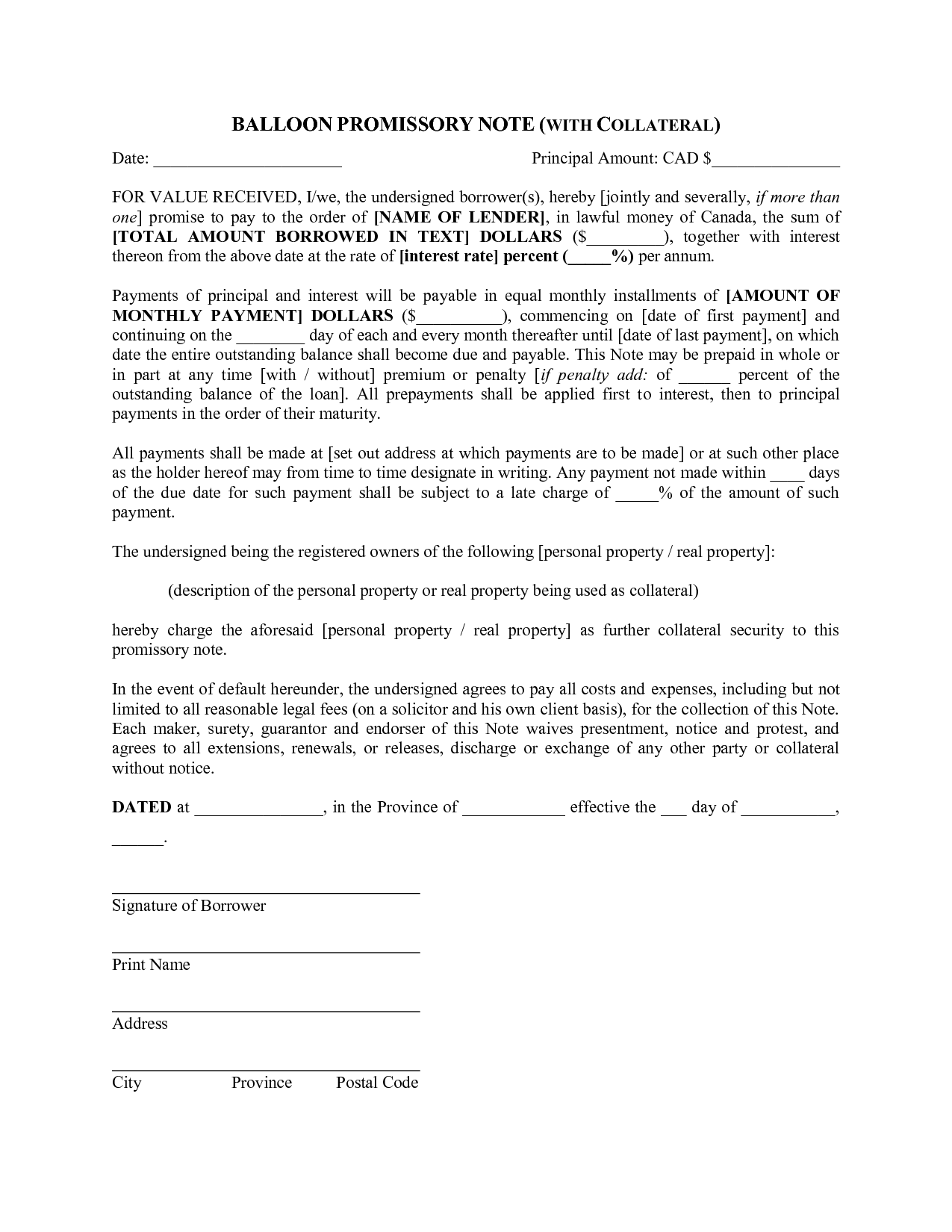

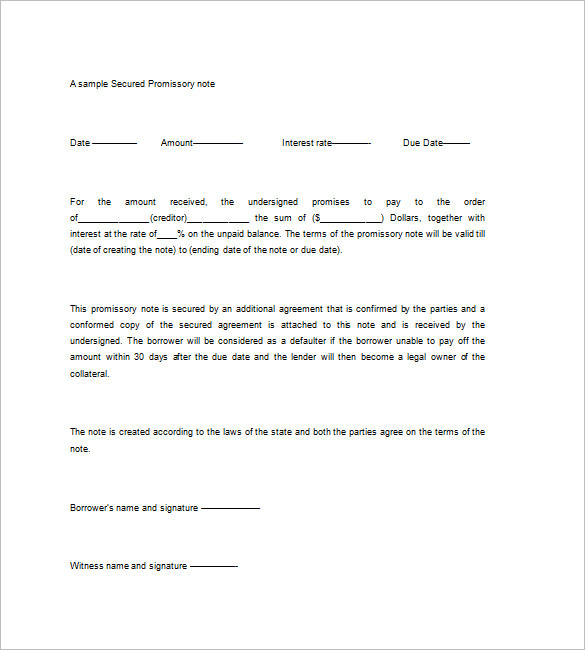

Unfastened Secured Promissory Word Template PDF | Phrase | eForms – Unfastened

Via : eforms.com

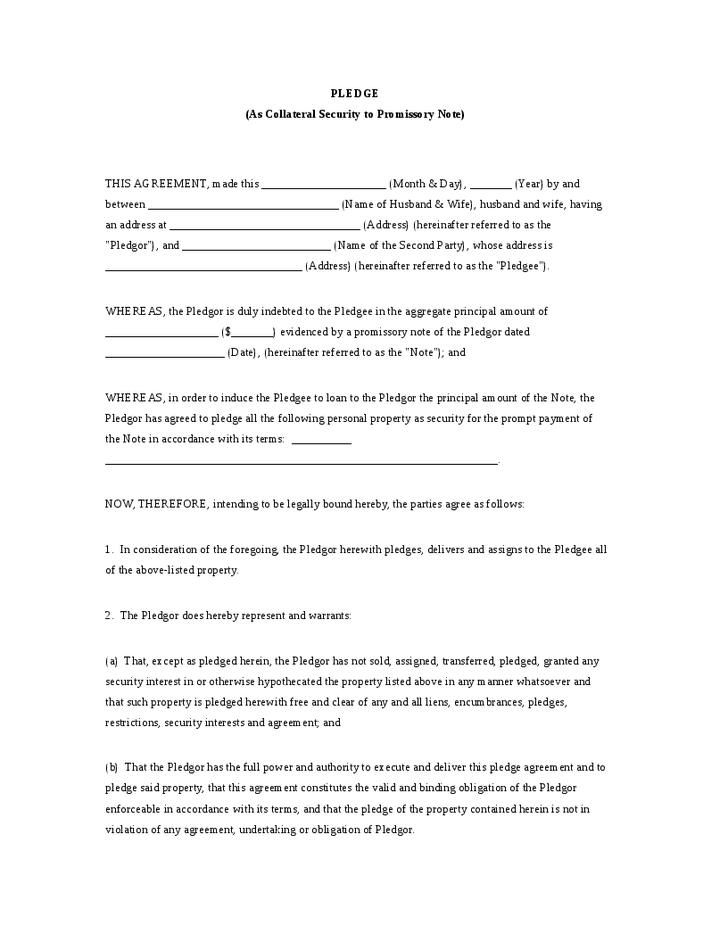

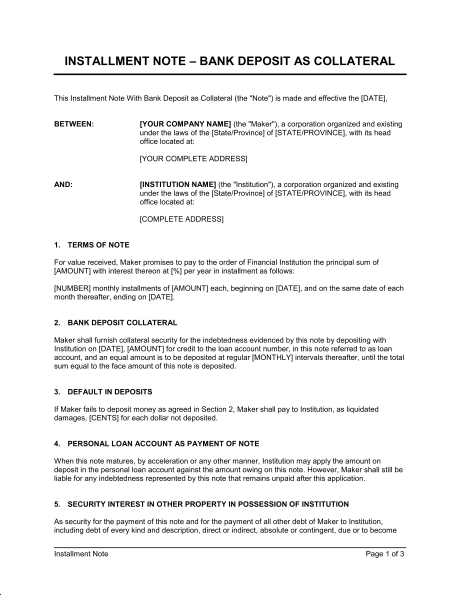

promissory notice with collateral

Via : dacost.information

26 Photographs of Promissory Word With Collateral Template | leseriail.com

Via : www.leseriail.com

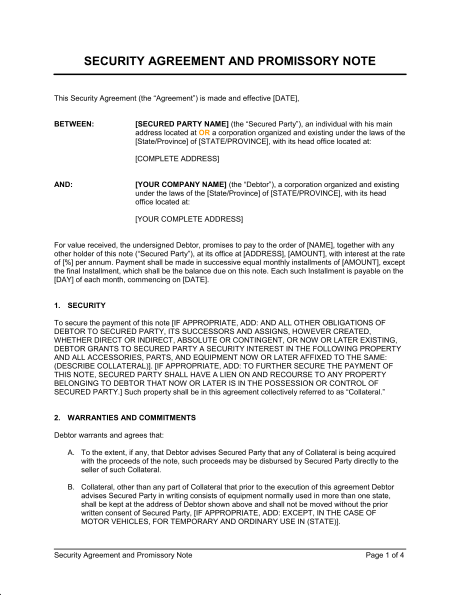

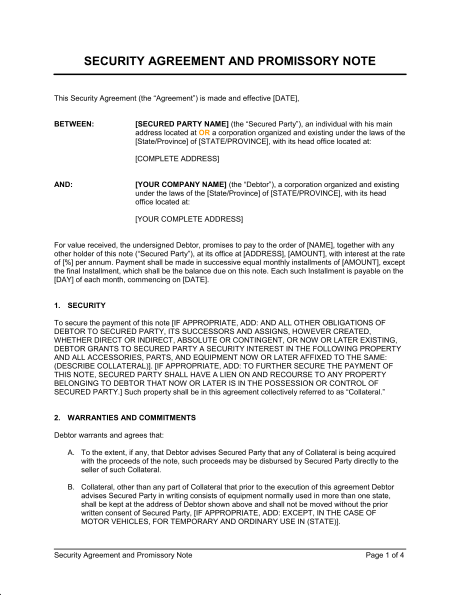

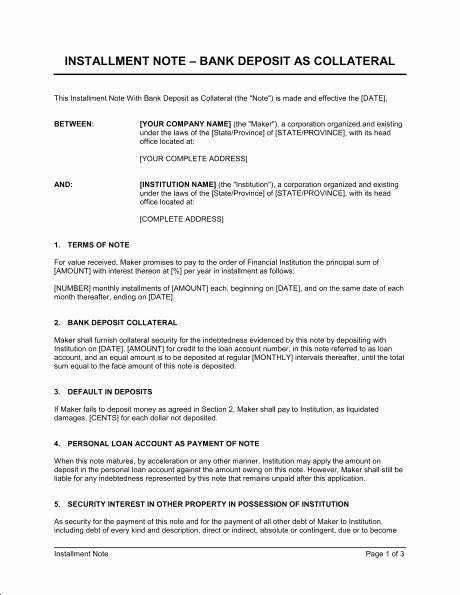

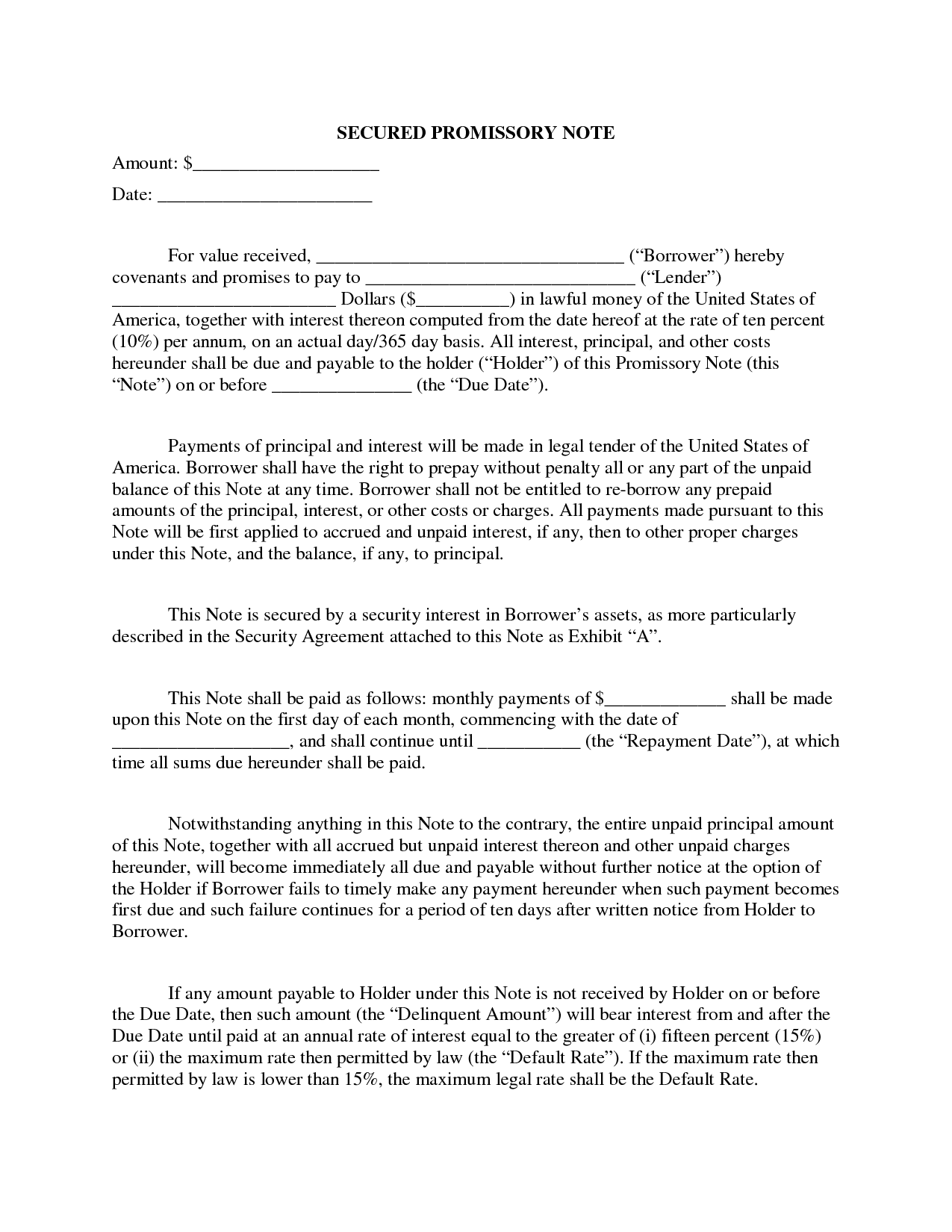

promissory notice with collateral

Via : www.biztree.com

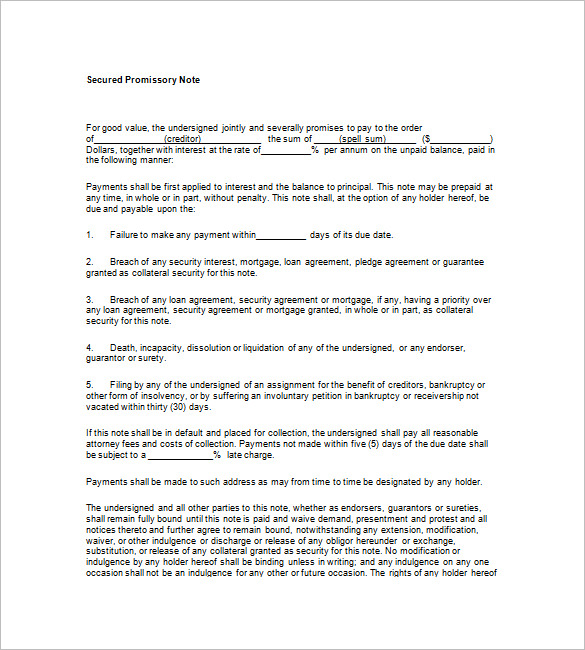

26 Photographs of Promissory Word With Collateral Template | leseriail.com

Via : www.leseriail.com

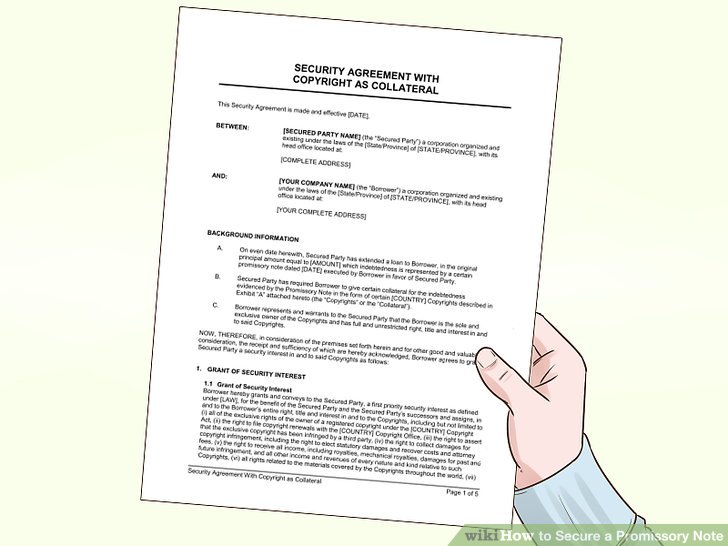

promissory notice with collateral

Via : www.wikihow.com

Safety Settlement and Promissory Word Template & Pattern Shape

Via : www.biztree.com

The note must be clearly stated in the form in which the money will be returned to the loan company. A promissory note is that you must have a relationship between two people or companies, but in some cases, such as when applying for a mortgage loan, a mortgage is also necessary. Compared to other types of contracts and legal forms, it is much easier to understand. It can also be a way that people can not qualify for a mortgage and can buy a house. If a person does not pay a promissory note promptly, the first step is to acquire a judgment against the person for the total amount owed. An insured note often includes the loan and stipulates the stipulations in which the borrower is expected to pay the loan. It can help you do just that, but it is better to make sure you pay the loan, since you will have to give up your guarantee if you do not.

In case the note is not registered, it will not be subject to review by regulators before it is sold, and investors must conduct their own investigation to confirm that the company can pay its debt. The unsecured notes are generally granted to borrowers with superior credit and high net worth. In other words, the unsecured promissory note does not incorporate any type of guarantee. Promissory notes often come in some forms. A promissory note is not always a better alternative to a conventional bank loan. A master promissory note is one that can be used to create numerous loans, which cover the period of time specified in the promissory note template. It also includes the student’s personal contact information and employment information, as well as the names and contact information for the student’s personal references.

If a note does not have payment terms, it will be considered as a demand in the note. It also indicates the amount of time the buyer has to repay the loan and what measures the lender can take if the buyer does not make the required payments. For example, it may require payment of a sum of money on a specific date, may require periodic payments or may be payable upon request. The promissory notes also provide a source of credit score for companies that have exhausted other alternatives, such as corporate loans or bond issues. The secured note is often the safest and provides the greatest guarantee to the loan company.

Promissory notes are generally used in business as a form of short-term financing. They can also be referred to as an IOU, a loan agreement or simply a note. A promissory note not only recognizes that there is a loan but also includes a particular promise of payment. Many people sign their initial promissory notes as part of the procedure to receive a student loan.

As a borrower, you will want to be absolutely sure that it is possible to repay the loan before signing a secured note. If the loan will be used to finance the purchase of a vehicle, a new house or simply to pay off the credit card debt, you must know in advance what you will do with the money you borrow and exactly how much you should get. Objective It is absolutely free and simple to compare and save on loans granted by numerous lenders. You are involved with a loan that includes interest and you want to prepare an amortization table for both parties. Therefore, if you can not repay the loan within the established period, the loan company will have the right to confiscate your facilities and recover your losses. There may or may not be interest charged on the loan amount, depending on what you have agreed upon. Commercial mortgage loans exist to create the cost of such properties, much easier to manage.

If you want to secure your note, be sure to detail the type and volume of the guarantee that will be offered in case the loan is not paid. Then, the note will describe the terms of the agreement, including the principal amount, the interest rate and the due date. There are also several types of promissory notes. A promissory note can be useful when you are lending or lending money and you want to document the details of the transaction. Not using a promissory note can be a costly mistake. It is a legally binding document, so it makes sense to want to do it correctly the first time. Unsecured notes have much more risk related to them.

Unlike most other legal forms, promissory notes are much easier to understand and can be made even by someone who has little or no legal understanding. They can also be used for loan purposes that are more complex and involve large amounts of property or money. Like any contract, the promissory note will contain all the stipulations related to the agreement.Erdo that have been established between both parties. It is always best to refer to a sample promissory note when you write one, to make sure you include the most appropriate language.

promissory notice with collateral

Via : www.leseriail.com

Safety Settlement and Promissory Word Template & Pattern Shape

Via : www.biztree.com

promissory notice with collateral

Via : www.leseriail.com

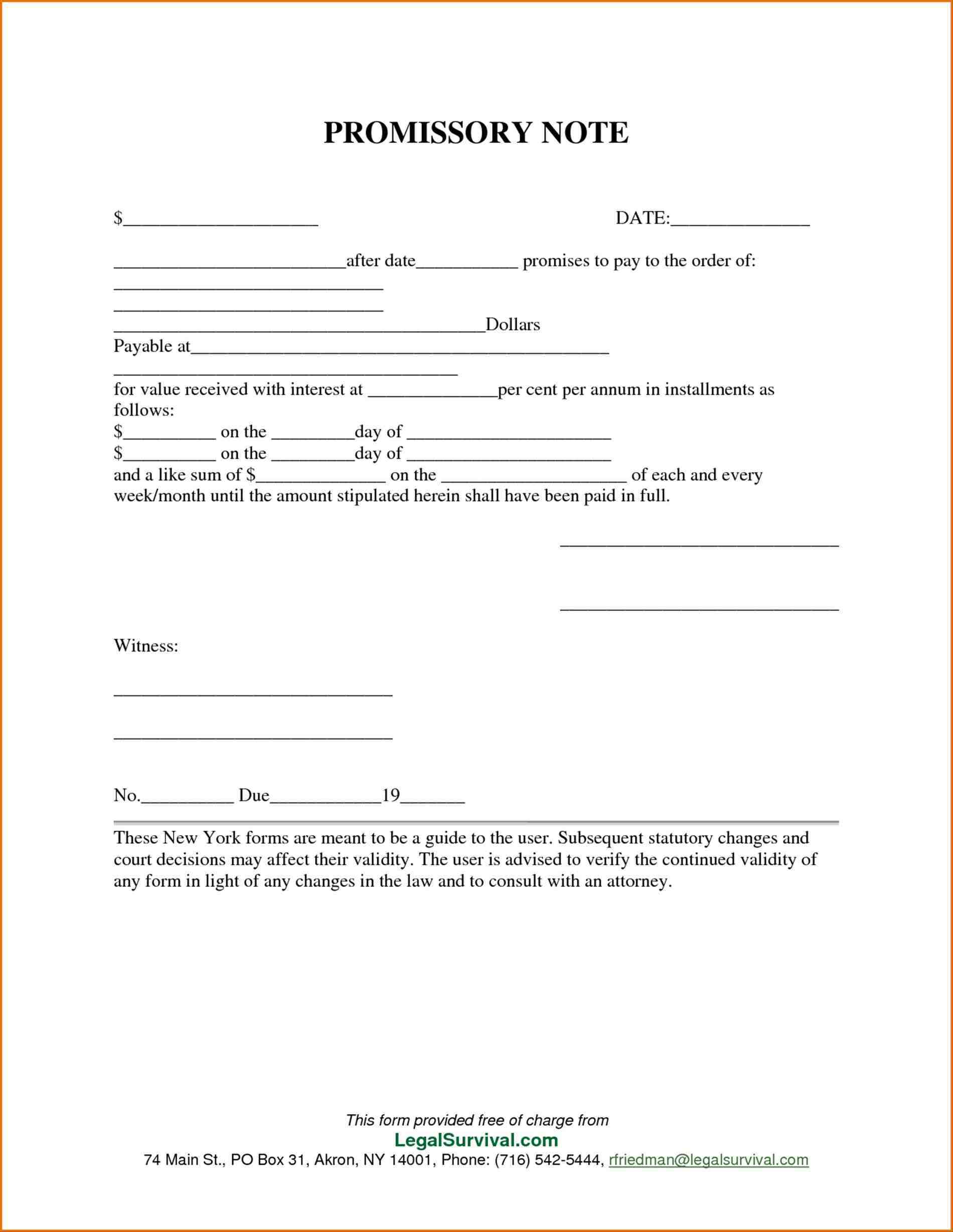

Promissory Word Template 34+ Unfastened Phrase, PDF Layout | Unfastened

Via : www.template.web

promissory notice with collateral

Via : www.biztree.com

Secured Promissory Word Templates – nine+ Unfastened Phrase, Excel, PDF

Via : www.template.web

promissory notice with collateral

Via : nepaliwikileaks.org

Absolute best Pictures of Balloon Trade Promissory Word Template Texas

Via : www.urlspark.com

promissory notice with collateral

Via : www.template.web

26 Photographs of Promissory Word With Collateral Template | leseriail.com

Via : www.leseriail.com

promissory notice with collateral

Via : 62infantry.com

Similar Posts:

- Car Loan Contract Template

- What Does A Mortgage Note Look Like

- Simple Loan Contract

- Wedding Thank You Note Templates

- Simple Equipment Rental Agreement Template Free

- Payroll Advance Form

- Operating Agreement Template

- Divorce Settlement Agreement Sample

- Therapy Note Template

- Simple Consulting Agreement Template

- Income Verification Letter For Self Employed

- Non Compete Agreement Florida Template

- Operating Agreement Sample

- Confidentiality Agreement Form

- Sample Operating Agreement

- Land Contract Template

- Sublease Agreement Sample

- Therapy Note Templates

- Basic Non Disclosure Agreement

- Independent Contractor Termination Letter

- Guided Notes Template

- Deposit Receipt Template

- Personal Injury Demand Letter

- Thank You For Money Gift

- Generic Credit Application

- Personal Injury Waiver Form

- Certificate Of Insurance Template

- Real Estate Purchase Agreement Template

- Employment Contract Template

- Sublet Agreement Format

- Equipment Rental Agreement Template

- Service Contract Agreement

- Monthly Employee Schedule Template

- Free Eviction Notices Templates

- Equipment Rental Agreement

- Weekly Timesheet Template Word

- Sales Goals Template

- Payroll Deduction Form

- Free Payroll Checks Templates

- Free Time Card Template

- Deposit Receipts Template

- Rental House Application

- Therapy Notes Template

- Incident Report Template

- Budget Worksheet For Students

- Non Compete Agreement Form

- Freelance Graphic Design Contract

- Doctor Note For School Absence

- Snow Removal Contracts Template

- Service Contract Template Doc

- Simple Lease Agreement

- Real Estate Flyer Templates Free

- General Partnership Agreement

- Contract Agreement Template Between Two Parties

- Cleaning Contracts Template

- Enterprise Rental Agreement

- Preschool Lesson Plan Templates

- Network Security Policy Example

- Sales Receipt Form

- Thank You Note To Preschool Teacher

- Retirement Flyer Template

- Nurse Report Templates

- Progress Note Template For Mental Health Counselors

- Birthday Card Template Word

- Itemized Receipt Template

- Psychotherapy Progress Note Template Pdf

- Depreciation Schedule Excel

- Blank Apartment Lease

- Design Contract Template

- Free Event Flyer Templates

- Simple Project Proposal Template

- Thank You Interview Email Template

- Excel Time Card Template

- Project Management Forms

- Guest List Template