Retirement Expense Worksheet

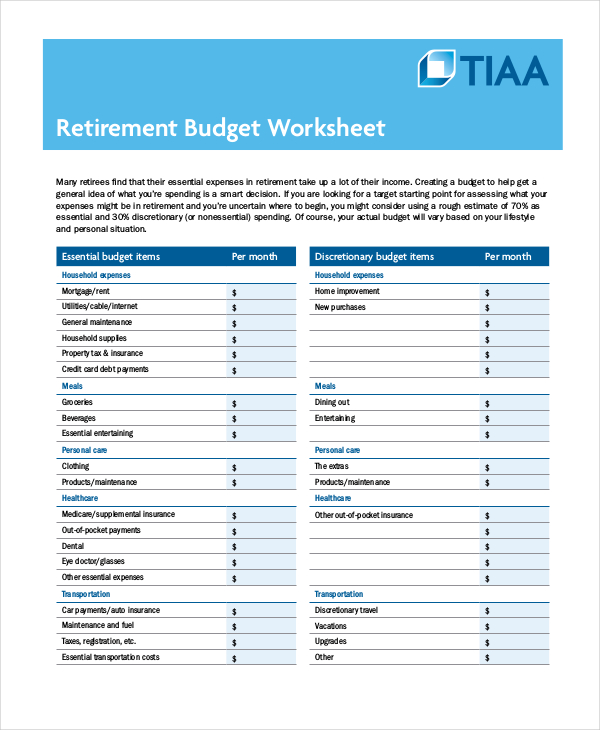

Worksheet that assist you to decide your retirement bills and create a practical funds in keeping with your retirement source of revenue. Use this software that can assist you estimate your retirement bills whilst taking inflation under consideration. Those hyperlinks to equipment, calculators, analysis and different sources assist you to with all facets of retirement making plans. See Catch-up contribution underneath Contribution Limits and Restrict on Optionally available Deferrals in chapters three and four, respectively, for more info.. Tax aid for sufferers of 2016 and 2017 screw ups. New regulations supply for tax-favored withdrawals and repayments from positive retirement plans for taxpayers who suffered financial losses because of screw ups declared by means of the President underneath segment 401 January 2018 (Recycle prior editions) Your Retirement Receive advantages: How It’s Figured. Produced and printed at U.S. taxpayer expense. Published on recycled paper To account for the ones bills (like automobile insurance coverage) for your per month funds, merely calculate the overall expense for the calendar 12 months and divide that by means of 12 with a purpose to in finding the “per month” expense.Write that quantity in the fitting row and column. How one can entire your per month funds worksheet. To start out, we recommend amassing all related monetary statements like your pay stubs, bank card expenses .

Imagine it or now not, a retirement funds may end up in extra a laugh for your golden years. Via having a plan, you can have much less tension, and creating a retirement funds is helping you keep away from one of the vital greatest retirement errors other folks make of spending an excessive amount of too quickly. Getting a maintain in your upcoming retirement Easy. Easy. Environment friendly. Whether or not you want to get set-up or document a declare, obtain the shape that matches and we’ll take it from there. Retirement Withdrawal Calculator This calculator from the American Institute For Financial Analysis lets you estimate the extent of inflation-adjusted withdrawals you’ll be able to take from retirement financial savings in keeping with such components as your age, how a lot assurance you require that your financial savings will strengthen you all through your making plans horizon and the extent of bills you pay. VISUAL ARTISTS. Obtain our expense tick list for visible artists PDF Model Obtain our expense tick list for visible artists Excel Worksheet Model Obtain our .

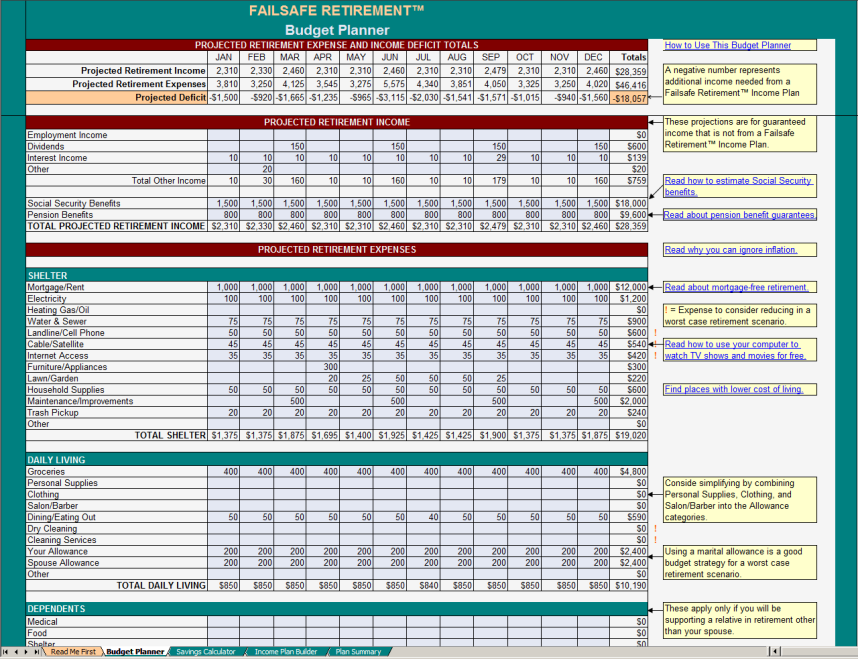

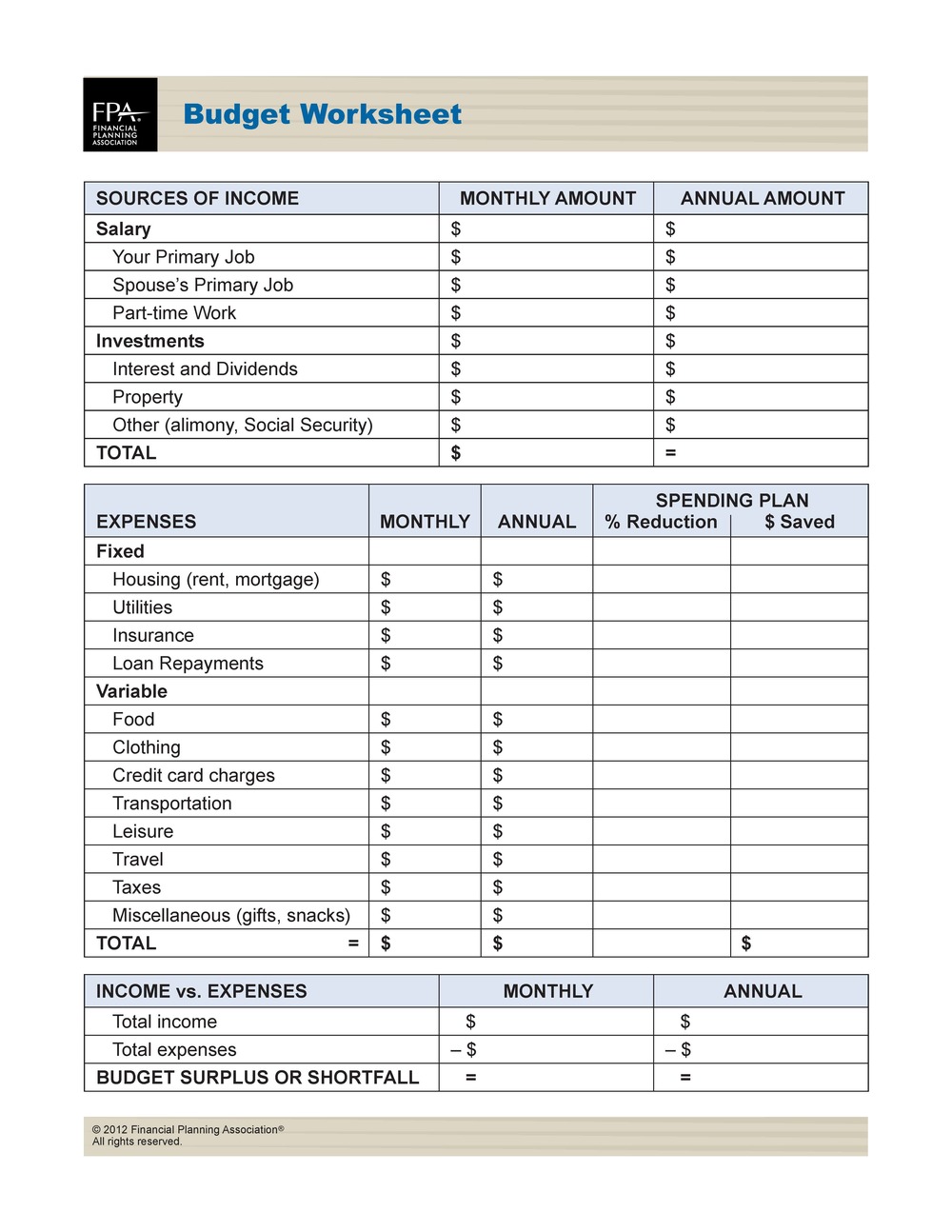

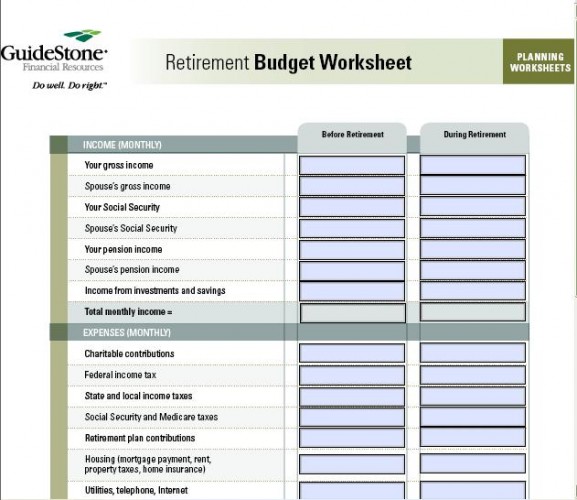

Fillable On-line Retirement expense worksheet BlackRock Fax E mail

Via : www.pdffiller.com

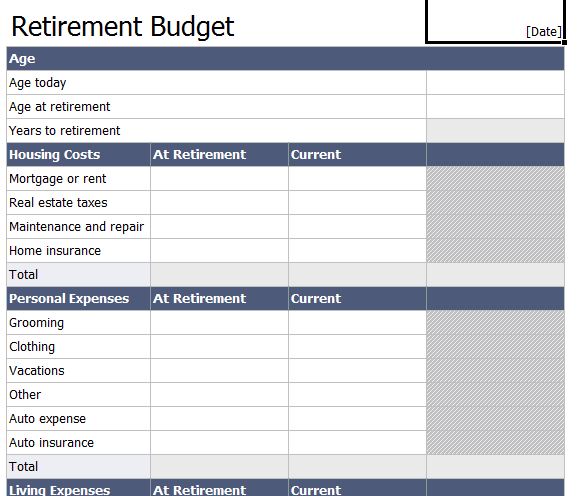

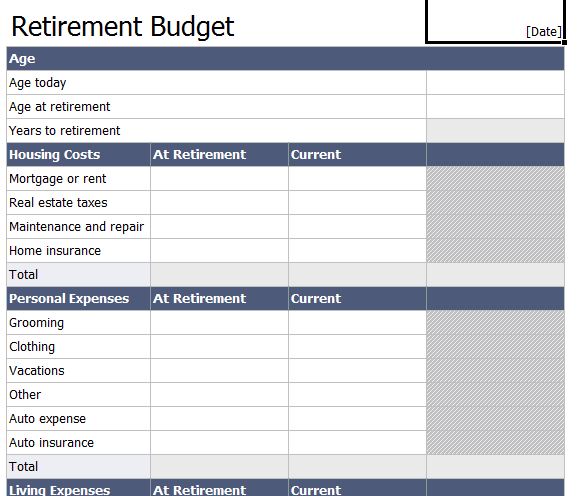

retirement expense worksheet

Via : mini.mfagency.co

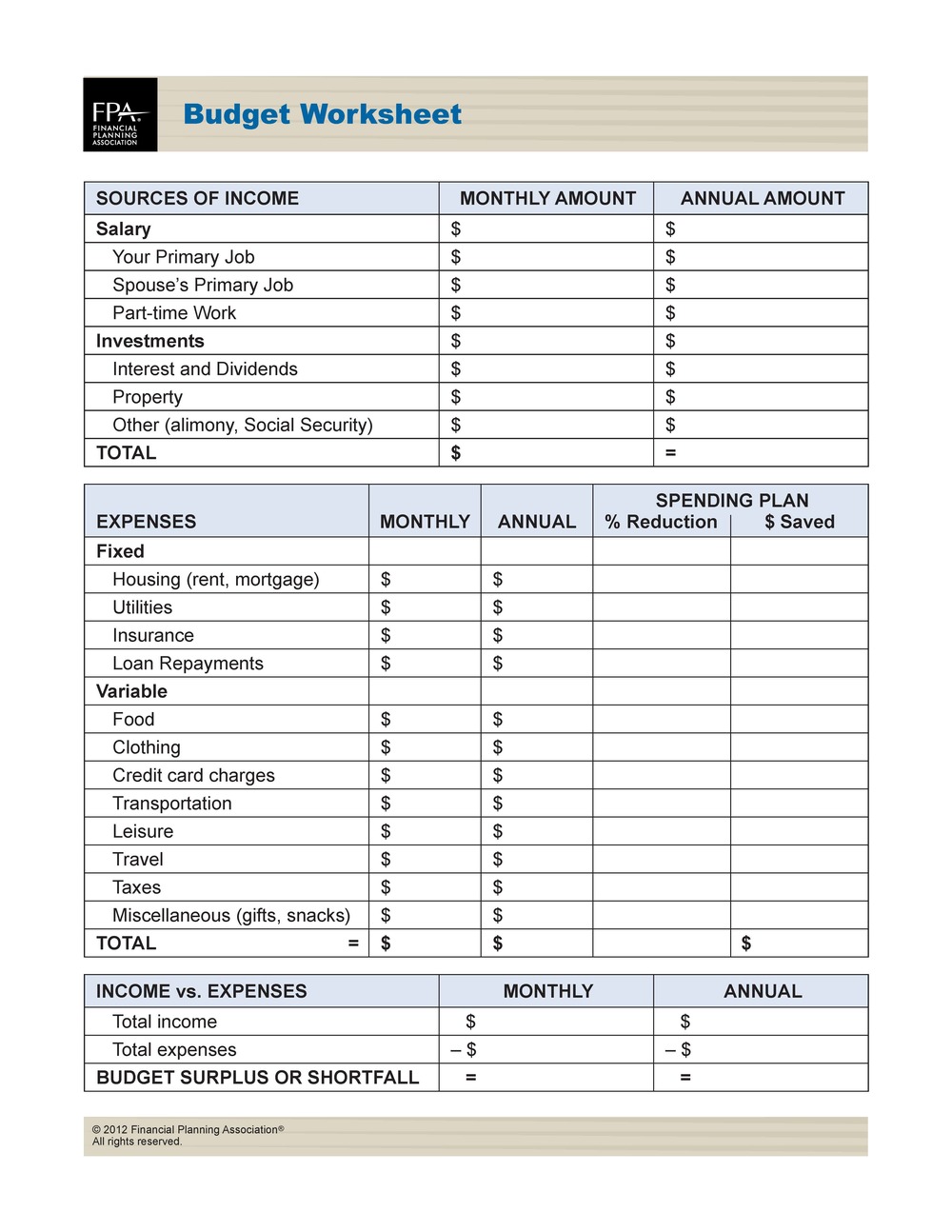

retirement funds shape Mini.mfagency.co

Via : mini.mfagency.co

retirement expense worksheet

Via : www.garybeene.com

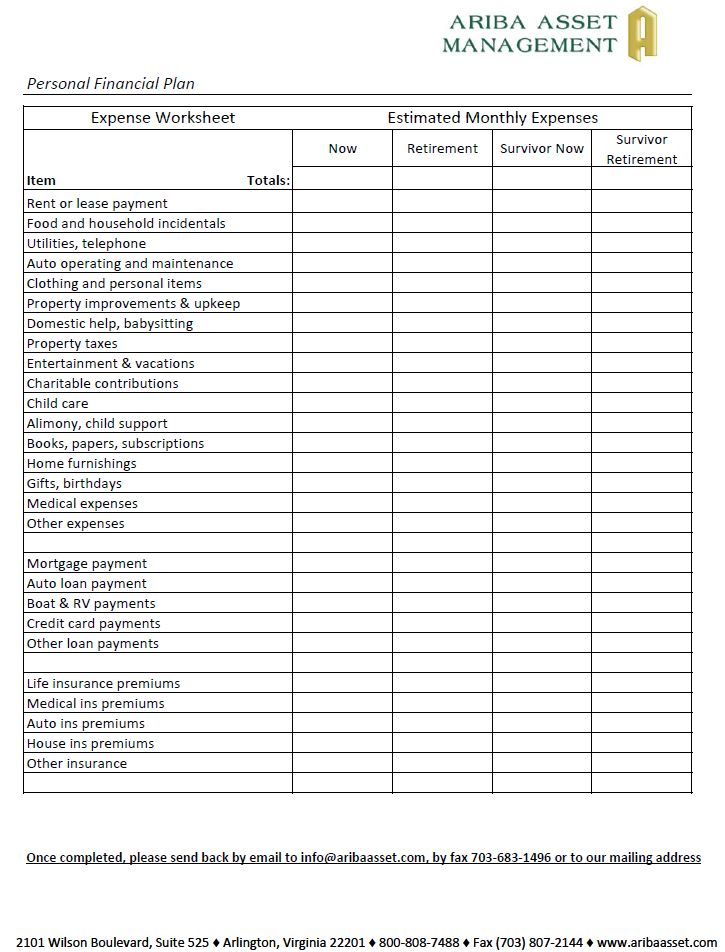

retirement funds shape Mini.mfagency.co

Via : mini.mfagency.co

retirement expense worksheet

Via : mini.mfagency.co

The main part of the worksheet lists the high impact assets and liabilities, and the flow of money related to each one. The worksheet in the 1040 instructions will demonstrate how to calculate your normal deduction. Worksheets are simpler in case you have never followed a budget because you can place them in your refrigerator or in a different visible area where you will not have to complete them. The preparation of divorce worksheets will be useful.

Making money by writing is not as simple as it once was, but it is not impossible. You do not need to spend a good amount of money on it to prove it. List each expense separately, then consider the details of each service to see if you can save some money. It is very important to recognize that you do not know how to end up costing money, harm the chances of success and significantly reduce the possibility of achieving the objectives of your company. Of course, if you decide to spend less, you can use the extra money for the other two components of your budget.

Knowing how easy it is to adjust your expenses in many categories helps you stay within your budget. In fact, if a budget is not well written, the hospital may not be able to provide medical services in any way. It is crucial that you continue with your financial plan and do not create new debts of any kind.

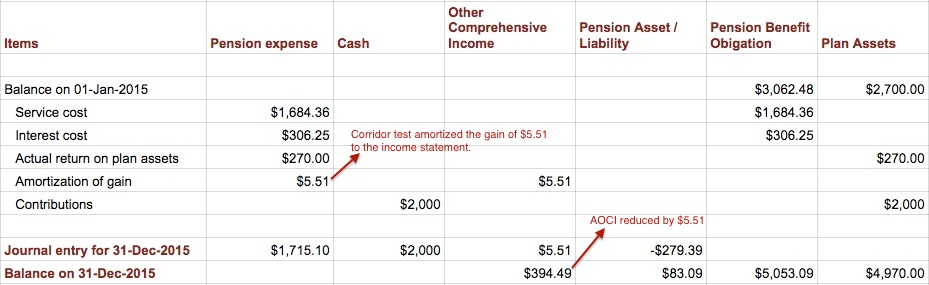

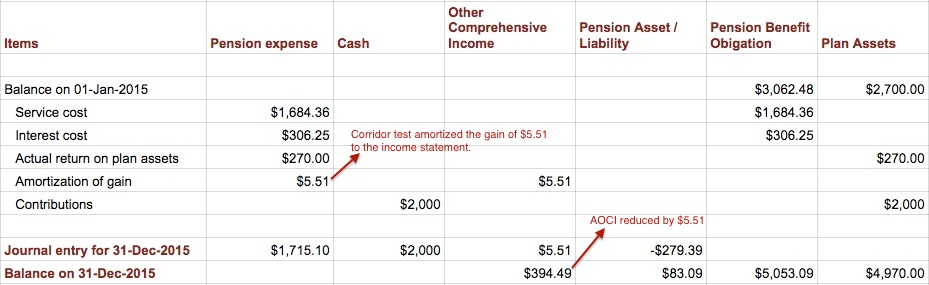

Amortization is comparable to the straight-line depreciation method. Depreciation is the decrease in the value of the property, during the time spent in the small business. The depreciation of the bonus is a deduction from the income tax that allows a taxpayer to deduct 100% of the price of a specific property put into service during 2011. It is a deduction from the income tax that allows a taxpayer to recover the cost or other basis of a certain property used in the business, during a certain period of time. It is not surprising that depreciation and amortization are used interchangeably.

Health insurance companies, for example, generally have a general idea of ??how much they will pay in liabilities unless there is a sudden outbreak of an epidemic. For example, if your company is a new company, the capital stock could increase, since you have increased your investment in the company or you have managed to obtain some risk capital. When you have decided to start your own business, it is tempting to leave your job in order to offer your full attention to your new business. Getting your own company is more than just creating a job for yourself. Choosing an expert with specialized skills may be the most cost-effective decision you can make to protect both your company and the financial future.

It must indicate the form of the asset, how it is titled and its value. The depreciation method you use for any specific asset is set at the time you put the asset into service for the first time and, therefore, can not be changed. At any time you acquire an asset such as a residential, rental or investment property, you have a cost basis linked to the acquisition. On the other hand, equity could decrease since you finally reached the stage where you can start to take money out of the company. The countable capital of an organization is the total amount of the participation of the investors in the firm.

Pay first, even if you are in debt. Just as it is impossible to predict a debt that may or may not occur, it does not indicate that it should not be disclosed. The debt is borrowed money with the expectation that it will be paid in a certain period of time. If you are in debt, you may feel overwhelmed and have no idea how you are likely to get out of the hole you have gotten into. A contingent debt is not a definitive liability because it is based on the results of an event, including a judicial verdict. It is a type of unusual debt that depends on uncertain future developments. Such contingent debt is comparatively simple to deal with.

For the budget to work, you may have to allocate expenses between both groups. Talk to a tax professional to make sure you include all the deductible expenses that are available to you. So many expenses and sources of income must be taken into account, or the budgetary procedure requires an expert to do it successfully. If you are not sure how to calculate your net income, you can find a food stamp benefits calculator at GetSNAP.Org. Property taxes are sometimes a real hardship for the elderly. Donate to charities provides a tax deduction quickly and effortlessly, as long as you do it the right way.

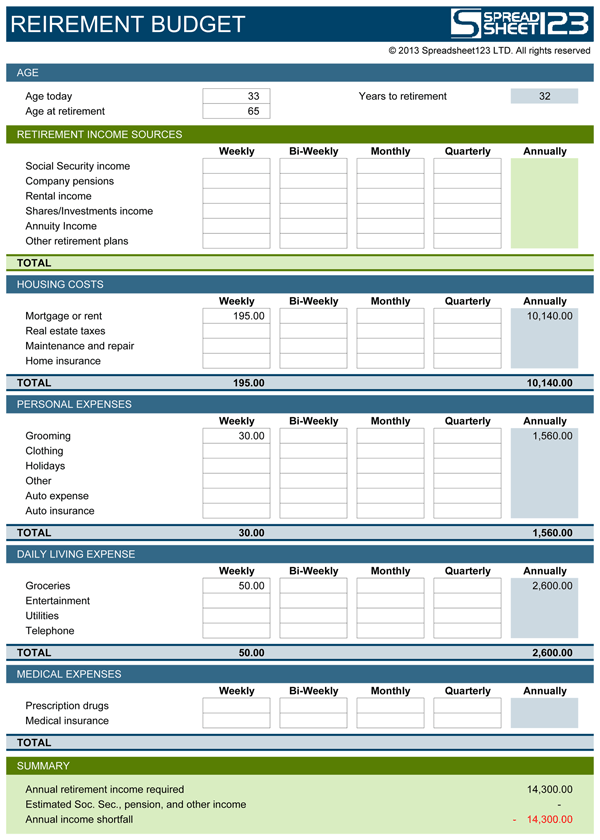

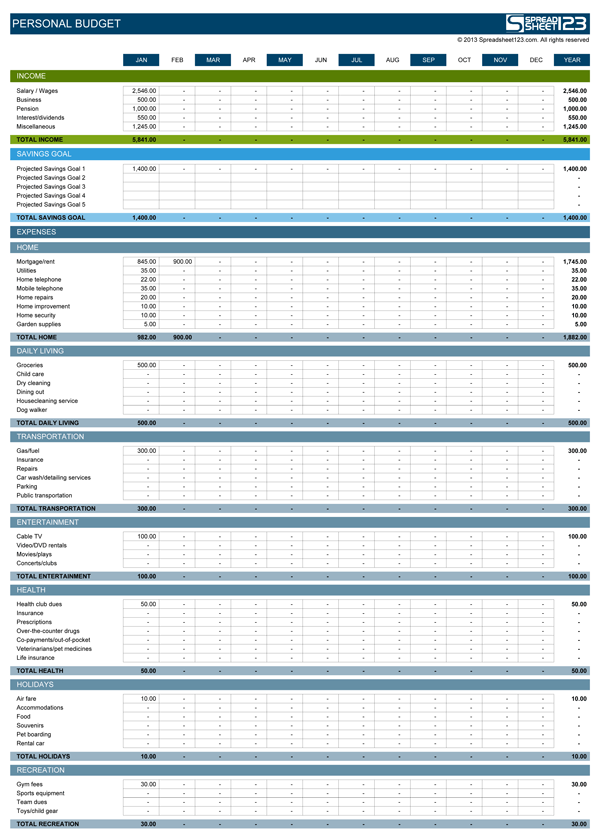

Retirement Funds Planner | Loose Template for Excel

Via : www.spreadsheet123.com

retirement expense worksheet

Via : mini.mfagency.co

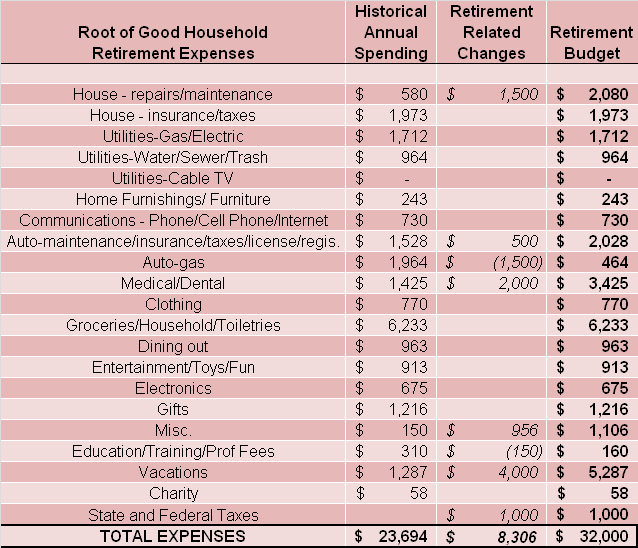

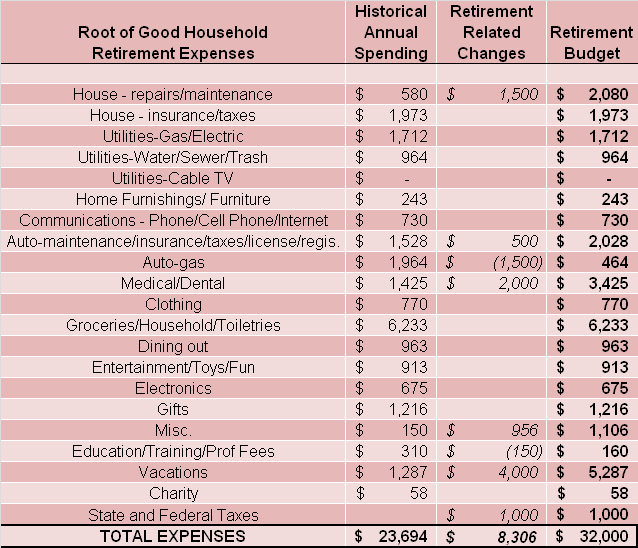

Retirement Bills Worksheet The most efficient worksheets symbol assortment

Via : bookmarkurl.data

retirement expense worksheet

Via : mini.mfagency.co

Retirement Bills Worksheet The most efficient worksheets symbol assortment

Via : bookmarkurl.data

retirement expense worksheet

Via : mini.mfagency.co

expense worksheet highest footage of per month spending sheet loose

Via : youthmatters.data

retirement expense worksheet

Via : www.spreadsheet123.com

retirement funds worksheets Mini.mfagency.co

Via : mini.mfagency.co

retirement expense worksheet

Via : bookmarkurl.data

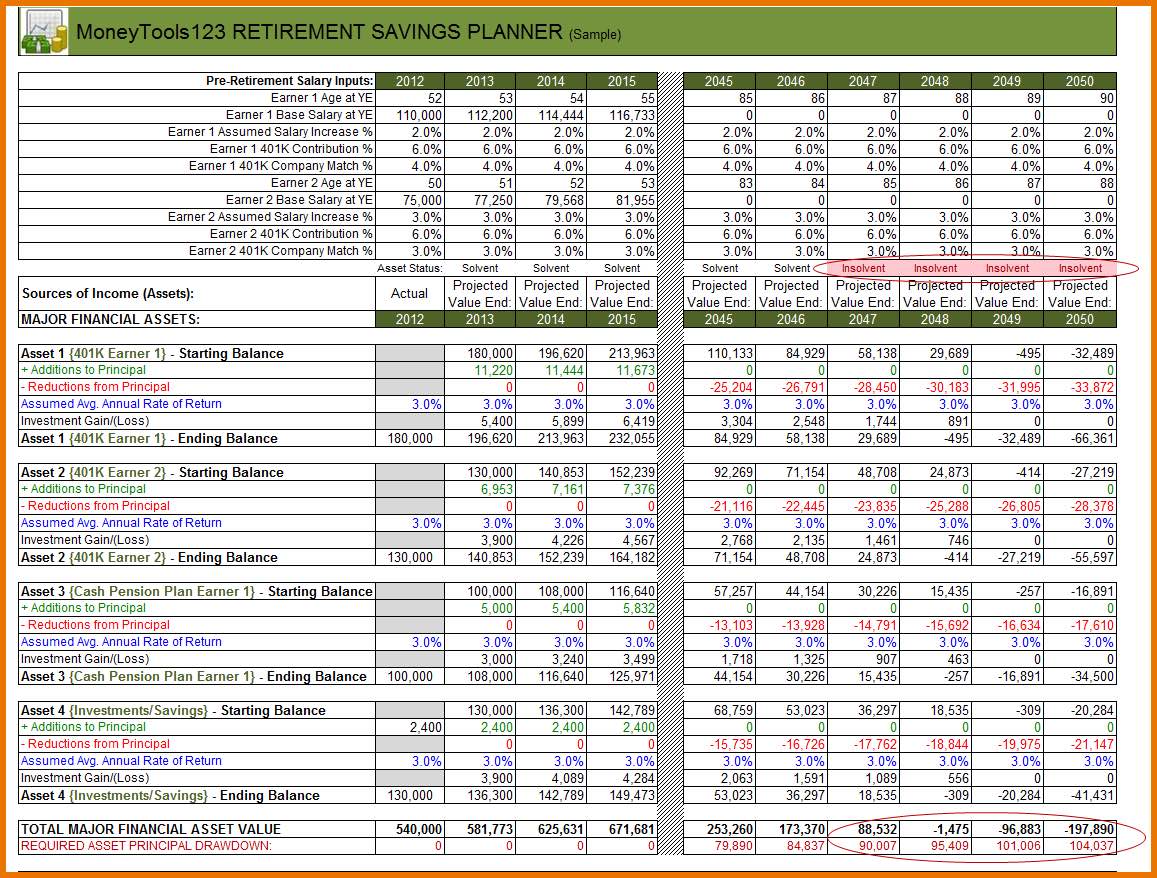

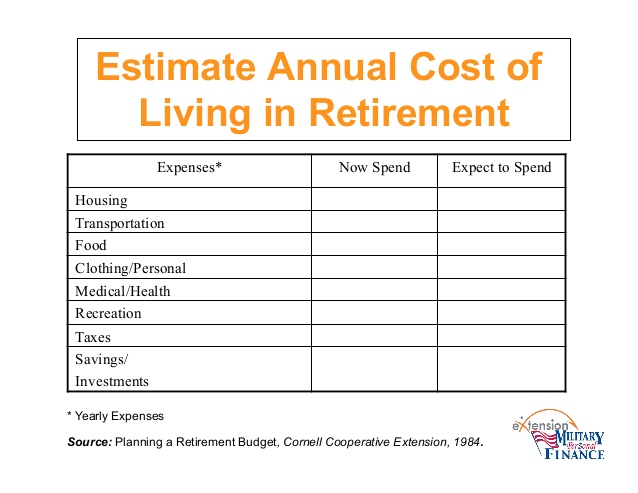

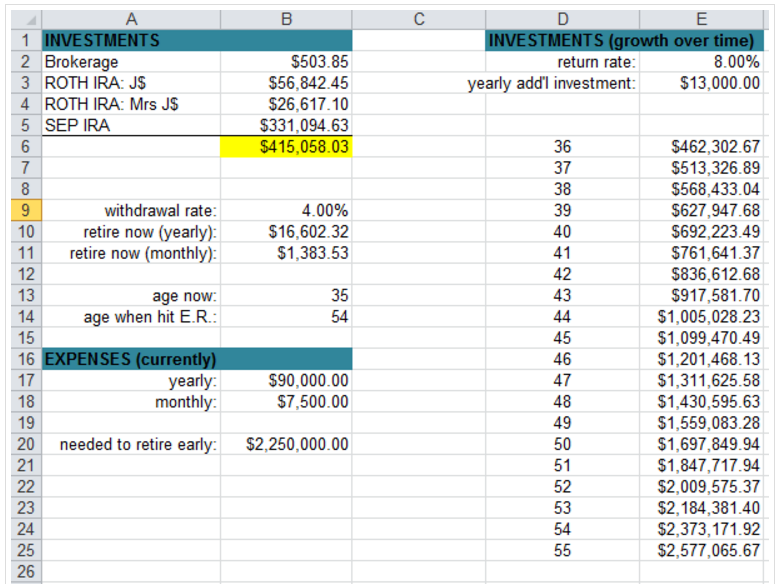

Calculating What to Save for Retirement

Via : www.slideshare.internet

retirement expense worksheet

Via : mini.mfagency.co

retirement worksheets Mini.mfagency.co

Via : mini.mfagency.co

retirement expense worksheet

Via : janav.wordpress.com

Similar Posts:

- Business Budget Worksheet

- Budget Worksheet For Students

- Operating Budget Template

- Budget Tracker Template

- Business Expense Template

- Blank Income Statement Template

- Depreciation Schedule Excel

- Business Expense Tracking

- Free Expense Report Form Pdf

- Nonprofit Budget Template

- Income Statement Excel

- Income Statement Excel Template

- Simple Profit And Loss Statement Excel

- Excel Bill Tracker

- Use Of Funds Template

- Income Statement Template

- Income Statement Template Excel

- Preschool Calendar Templates

- Balance Sheet Template Excel

- Mileage Log Excel

- Excel Income Statement

- Order Sheet Template

- Blank Apartment Lease

- Mileage Reimbursement Form

- Equipment Rental Contract Template

- Sale Receipt Forms

- Letters For Donation

- Weekly Timesheet Template Word

- Non Profit Budget Template

- Pricing Sheet Template

- Project Plan Document

- Sample Donation Request Letter For School

- Retirement Flyer Template

- How To Format A Scholarship Essay

- Real Estate Flyer Templates Free

- Stock Certificate Sample

- Raffle Tickets Template

- Psychotherapy Treatment Plan Template

- Printable Birth Plan Template

- Excel Income Statement Template

- Real Estate Business Plan Template

- Childrens Book Templates

- 10th Step Inventory

- Itemized Receipt Template

- Simple Consulting Agreement Template

- Non Compete Agreement Form

- Generic Credit Application

- Simple Loan Contract

- Payroll Deduction Form

- Fundraising Thank You Letter

- Check Register Worksheet

- How To Write A Personal Letter Of Recommendation

- Employee Attendance Calendar

- Deposit Slip Templates

- Membership Application Template

- Prenup Agreement Examples

- Rent Invoice Template

- Risk Management Plan Example

- Referral Form Templates

- Deposit Slips Template

- Nanny Resume Template

- Excel Time Card Template

- Donation Request Letter For School

- Production Plan Template

- Real Estate Purchase Agreement Template

- Inventory Sheet Sample

- Free Checkbook Register Software

- Sample Letters Asking For Donations

- Enterprise Rental Agreement

- Daily Schedule Template Word

- Financial Advisor Business Plan

- Deposit Receipts Template

- Free Editable Newsletter Templates For Word

- Letter For Donations

- Realtor Marketing Plan